Zynga 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

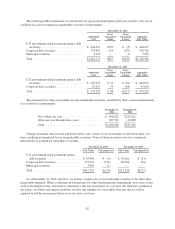

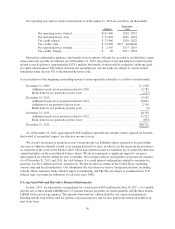

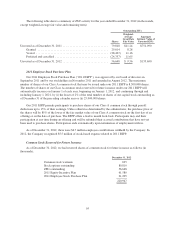

Concurrent with the execution of the loan agreement, to eliminate variability in interest payments, we

entered into an interest rate swap agreement, such that the interest rate is fixed at two percent. We have

designated the interest rate swap as a qualifying hedging instrument and accounted for it as a cash flow hedge in

accordance with ASC 815, Derivatives and Hedging. If the hedged transactions become probable of not

occurring, the corresponding amounts in accumulated other comprehensive income would be reclassified to other

income (expense), net in our consolidated statements of operations. The fair value of the interest rate swap was

$2.4 million as of December 31, 2012 and was recorded in the consolidated balance sheets in other current and

non-current liabilities. We initially record the gain or loss on the effective portion of the hedge as a component of

accumulated other comprehensive income (loss) and subsequently reclassify it to interest expense in other

income (expense), net when the hedged transaction occurs which is once per quarter commensurate with the date

of our interest payment. As of December 31, 2012, we expect to reclassify approximately $0.9 million net from

accumulated other comprehensive income (loss) into other income (expense), net in the next 12 months, along

with the earnings impact of the related forecasted hedged transactions.

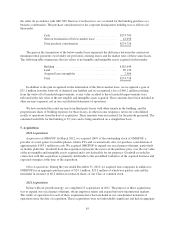

Credit Facility

In July 2011, we executed a revolving credit agreement with certain lenders to borrow up to $1.0 billion in

revolving loans. Per the terms of the credit agreement, we paid upfront fees of $2.5 million, which were

capitalized and are to be amortized over the term of the credit agreement, and we are required to pay ongoing

commitment fees of up to $0.6 million each quarter based on the portion of the credit facility that is not drawn

down. The interest rate for the credit facility is determined based on a formula using certain market rates, as

described in the credit agreement. As of December 31, 2012, we have not drawn down any funds under the terms

of the credit agreement.

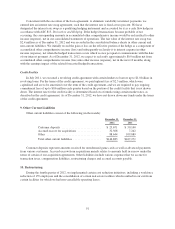

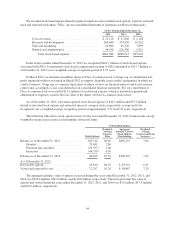

9. Other Current Liabilities

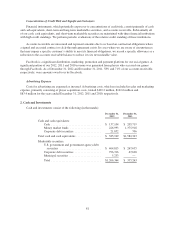

Other current liabilities consist of the following (in thousands):

December 31, December 31,

2012 2011

Customer deposits ........................... $ 25,671 $ 50,140

Accrued escrow for acquisitions ................ 32,568 7,242

Other ..................................... 88,644 109,889

Total other current liabilities ................... $146,883 $167,271

Customer deposits represent amounts received for unredeemed game cards as well as advanced payments

from various customers. Accrued escrow from acquisitions mainly relates to amounts held in escrow under the

terms of certain of our acquisition agreements. Other liabilities include various expenses that we accrue for

transaction taxes, compensation liabilities, restructuring charges and accrued accounts payable.

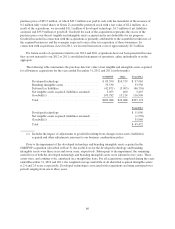

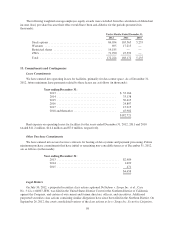

10. Restructuring

During the fourth quarter of 2012, we implemented certain cost reduction initiatives, including a workforce

reduction of 155 employees and the consolidation of certain real estate facilities which resulted in our exit from

certain facilities for which we had non-cancellable operating leases.

91