Zynga 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

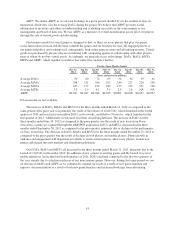

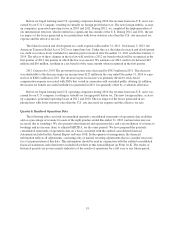

ABPU. We define ABPU as (i) our total bookings in a given period, divided by (ii) the number of days in

that period, divided by, (iii) the average DAUs during the period. We believe that ABPU provides useful

information to investors and others in understanding and evaluating our results in the same manner as our

management and board of directors. We use ABPU as a measure of overall monetization across all of our players

through the sale of virtual goods and advertising.

Our business model for social games is designed so that, as there are more players that play our games,

social interactions increase and the more valuable the games and our business become. All engaged players of

our games help drive our bookings and, consequently, both online game revenue and advertising revenue. Virtual

goods are purchased by players who are socializing with, competing against or collaborating with other players,

most of whom do not buy virtual goods. Accordingly, we primarily focus on bookings, DAUs, MAUs, MUUs,

MUPs and ABPU, which together we believe best reflect key audience metrics.

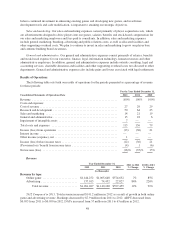

For the Three Months Ended

Dec 31,

2012

Sep 30,

2012

Jun 30,

2012

Mar 31,

2012

Dec 31,

2011

Sep 30,

2011

Jun 30,

2011

Mar 31,

2011

(users and payers in millions)

Average DAUs .................. 56 60 72 65 54 54 59 62

Average MAUs .................. 298 311 306 292 240 227 228 236

Average MUUs .................. 167 177 192 182 153 152 151 146

Average MUPs .................. 2.9 2.9 4.1 3.5 2.9 2.6 NA NA

ABPU ......................... $0.051 $0.047 $0.046 $0.055 $0.061 $0.058 $0.051 $0.051

NA means data is not available.

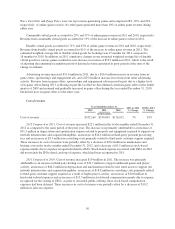

The increase in DAUs, MAUs and MUUs for the three months ended March 31, 2012 as compared to the

same period of the prior year was primarily the result of the release of CastleVille, which launched in the fourth

quarter of 2011 and reached seven million DAUs in two weeks, and Hidden Chronicles, which launched in the

first quarter of 2012. Additionally we released four titles on mobile platforms. The increase in DAUs for the

three months ended June 30, 2012 as compared to the prior quarter was the result of new users from Draw

Something, a game we acquired through the OMGPOP acquisition. DAUs and MUUs decreased in the three

months ended September 30, 2012 as compared to the prior quarter, primarily due to declines in the performance

of Draw Something. The decrease in DAUs, MAUs and MUUs for the three months ended December 31, 2012 as

compared to the prior quarter was the result of declines in web players and mobile players. Future growth in

audience and engagement will depend on our ability to retain current players, attract new players, launch new

games and expand into new markets and distribution platforms.

Our DAUs, MAUs and MUUs all increased in the three months ended March 31, 2011, primarily due to the

launch of CityVille in December 2010, the addition of new content to existing games and the launch of several

mobile initiatives. In the third and fourth quarters of 2011, DAUs declined compared to the first two quarters of

the year, mainly due to a decline in players of our more mature games. However, during that same period we saw

an increase in MAUs and ABPU as we continued to expand our reach as a result of new game launches and

improve our monetization as a result of both new game launches and increased bookings from advertising.

43