Zynga 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

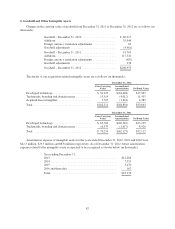

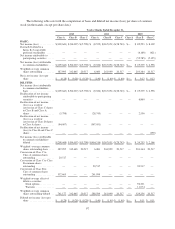

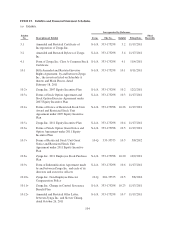

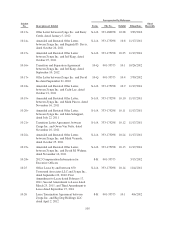

The following table sets forth the computation of basic and diluted net income (loss) per share of common

stock (in thousands, except per share data):

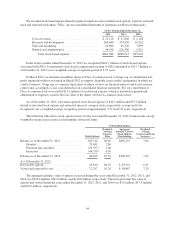

Twelve Months Ended December 31,

2012 2011 2010

Class A Class B Class C Class A Class B Class C Class A Class B Class C

BASIC:

Net income (loss) ........... $(109,643) $ (94,007) $ (5,798) $ (8,522) $(367,051) $(28,743) $— $ 82,293 $ 8,302

Deemed dividend to a

Series B-2 convertible

preferred stockholder ...... — — — — — — — (4,169) (421)

Net income attributable to

participating securities ..... — — — — — — — (52,785) (5,325)

Net income (loss) attributable

to common stockholders .... $(109,643) $ (94,007) $ (5,798) $ (8,522) $(367,051) $(28,743) $— $ 25,339 $ 2,556

Weighted-average common

shares outstanding ......... 387,995 332,665 20,517 6,083 261,999 20,517 — 203,364 20,517

Basic net income (loss) per

share ................... $ (0.28) $ (0.28) $ (0.28) $ (1.40) $ (1.40) $ (1.40) $— $ 0.12 $ 0.12

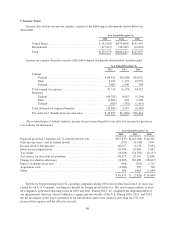

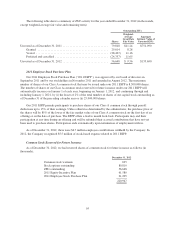

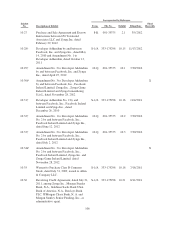

DILUTED:

Net income (loss) attributable

to common stockholders-

basic ................... $(109,643) $ (94,007) $ (5,798) $ (8,522) $(367,051) $(28,743) $— $ 25,339 $ 2,556

Reallocation of net income

attributable to participating

securities ................ — — — — — — — 6,860 —

Reallocation of net income

(loss) as a result of

conversion of Class C shares

to Class B and Class A

shares ................... (5,798) — — (28,743) — — — 2,556 —

Reallocation of net income

(loss) as a result of

conversion of Class B shares

to Class A shares .......... (94,007) — — (367,051) — — — — —

Reallocation of net income

(loss) to Class B and Class C

shares ................... — — — — — — — — (390)

Net income (loss) attributable

to common stockholders-

diluted .................. $(209,448) $ (94,007) $ (5,798) $(404,316) $(367,051) $(28,743) $— $ 34,755 $ 2,166

Weighted -average common

shares outstanding-basic .... 387,995 332,665 20,517 6,083 261,999 20,517 — 203,364 20,517

Conversion of Class C to

Class A common shares

outstanding .............. 20,517 — — — — — — — —

Conversion of Class C to Class

B common shares

outstanding .............. — — — 20,517 — — — 20,517 —

Conversion of Class B to

Class A common shares

outstanding .............. 332,665 — — 261,999 — — — — —

Weighted-average effect of

dilutive securities:

Stock options ........... — — — — — — — 94,301 —

Warrants .............. — — — — — — — 11,074 —

Weighted-average common

shares outstanding-diluted . . 741,177 332,665 20,517 288,599 261,999 20,517 — 329,256 20,517

Diluted net income (loss) per

share ................... $ (0.28) $ (0.28) $ (0.28) $ (1.40) $ (1.40) $ (1.40) $— $ 0.11 $ 0.11

97