Zynga 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

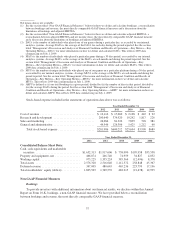

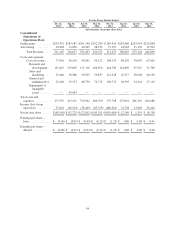

Other Metrics

Although our management primarily focuses on the operating metrics above, we also monitor periodic trends

in paying players of our games. The table below shows average monthly unique payer bookings, average MUPs and

unique payer bookings per unique payer for the last six quarters. These metrics are not available for the first and

second quarters of 2011 due to mobile payer data not becoming available until the third quarter of 2011:

For the Three Months Ended

Dec 31,

2012

Sep 30,

2012

Jun 30,

2012

Mar 31,

2012

Dec 31,

2011

Sep 30,

2011

Jun 30,

2011

Mar 31,

2011

Average monthly unique payer bookings

(in thousands)(1) ................... $72,867 $71,760 $86,282 $96,277 $90,839 $86,543 NA NA

Average MUPs (in millions) ............ 2.9 2.9 4.1 3.5 2.9 2.6 NA NA

Monthly unique payer bookings per

MUP(2) .......................... $ 25 $ 25 $ 21 $ 28 $ 31 $ 33 NA NA

NA means data is not available.

(1) Average monthly unique payer bookings represent the monthly average amount of bookings for the

applicable quarter that we received through payment methods for which we can quantify the number of

unique payers and excludes bookings generated from certain mobile payers in the first quarter of 2012 due

to our acquisition of OMGPOP late in that quarter, as well as bookings from certain payment methods for

which we cannot quantify the number of unique payers. Also excluded are bookings from advertising.

(2) Monthly unique payer bookings per MUP is calculated by dividing average monthly unique payer bookings

by average MUPs.

Average monthly unique payer bookings decreased in the second and third quarters of 2012. Monthly

unique payer bookings per MUP decreased from $28 in the first quarter of 2012 to $21 in the second quarter of

2012, due to an increase in MUPs in our mobile games, which generally monetize at a lower rate than our web

games. Monthly unique payer bookings per MUP increased to $25 in the third quarter of 2012, due to fewer

mobile MUPs. In the initial launch period of mobile games, such as the second quarter of 2012 that included the

first full quarter of new payers from Draw Something, we have seen increased MUPs due to one-time paid

download fees that tend to decline in subsequent periods after which in-game spending comprises a greater

percentage of mobile bookings.

Although we monitor our unique payer metrics, we focus on monetization, including through in-game

advertising, of all of our players and not just our payers. Accordingly, we strive to enhance content and our

players’ game experience to increase our bookings and ABPU, which is a measure of overall monetization across

all of our players through the sale of virtual goods and advertising.

Future growth in audience and engagement will depend on our ability to retain current players, attract new

players, launch new games and expand into new markets and distribution platforms, and the success of the Zynga

platform. Our operating metrics may not correlate directly to quarterly bookings or revenue trends in the short term.

Recent Developments

•Game Launches. We launched 22 games in 2012, including 11 titles on web platforms and 11 titles on

mobile platforms. In the fourth quarter of 2012, our releases included Bubble Safari Ocean,CityVille 2,

CoasterVille and The Friend Game on web platforms and Ayakashi and Party Place on mobile

platforms.

•Mobile Growth. In 2012 we saw 224% and 302% year-over-year growth in bookings and revenue,

respectively, on mobile platforms as our players continued to play our games on their phones and

tablets. In order to deliver on our mission of connecting the world through games, we are also

44