Zynga 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

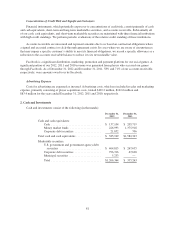

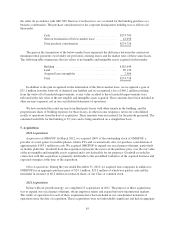

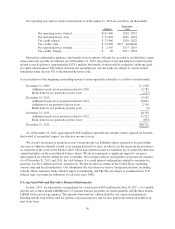

The following tables summarize our amortized cost, gross unrealized gains and losses and fair value of our

available-for-sale investments in marketable securities (in thousands):

December 31, 2012

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Aggregate

Fair Value

U.S. government and government agency debt

securities ............................ $ 464,517 $303 $ (5) $ 464,815

Corporate debt securities .................. 795,962 524 (170) 796,316

Municipal securities ..................... 5,234 — (1) 5,233

Total .................................. $1,265,713 $827 $(176) $1,266,364

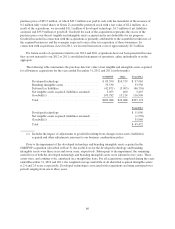

December 31, 2011

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Aggregate

Fair Value

U.S. government and government agency debt

securities ............................ $ 267,635 $ 53 $ (53) $ 267,635

Corporate debt securities .................. 67,657 35 (64) 67,628

Total .................................. $ 335,292 $ 88 $(117) $ 335,263

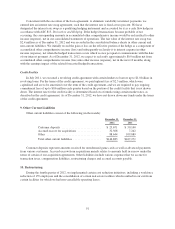

The estimated fair value of available-for-sale marketable securities, classified by their contractual maturities

was as follows (in thousands):

December 31,

2012

December 31,

2011

Due within one year .......................... $ 898,821 $225,165

After one year through three years ............... 367,543 110,098

Total ...................................... $1,266,364 $335,263

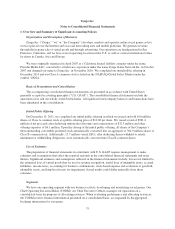

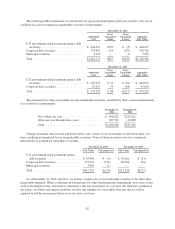

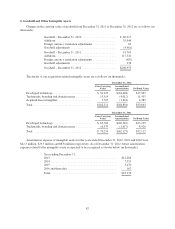

Changes in market interest rates and bond yields cause certain of our investments to fall below their cost

basis, resulting in unrealized losses on marketable securities. None of these securities were in a continuous

unrealized loss position for more than 12 months.

December 31, 2012 December 31, 2011

Fair Value Unrealized loss Fair Value Unrealized loss

U.S. government and government agency

debt securities ..................... $ 43,404 $ (5) $ 70,162 $ (53)

Corporate debt securities ............... 371,243 (170) 40,964 (64)

Municipal securities ................... 3,063 (1) — —

Total ............................... $417,710 $(176) $111,126 $(117)

As of December 31, 2012 and 2011, we did not consider any of our marketable securities to be other-than-

temporarily impaired. When evaluating our investments for other-than-temporary impairment, we review factors

such as the length of time and extent to which fair value has been below its cost basis, the financial condition of

the issuer, our ability and intent to hold the security and whether it is more likely than not that we will be

required to sell the investment before recovery of its cost basis.

82