Zynga 2012 Annual Report Download - page 86

Download and view the complete annual report

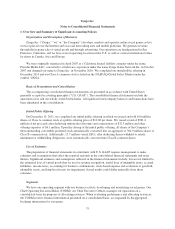

Please find page 86 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketable Securities and Non-Marketable Securities

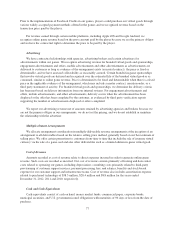

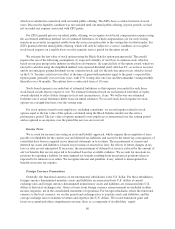

Marketable securities consist of U.S. government-issued obligations, municipal securities and corporate debt

securities. Management determines the appropriate classification of marketable securities at the time of purchase

and reevaluates such determination at each balance sheet date. The fair value of marketable securities is

determined as the exit price in the principal market in which we would transact. Based on our intentions

regarding our marketable securities, all marketable securities are classified as available-for-sale and are carried at

fair value with unrealized gains and losses recorded as a separate component of other comprehensive income, net

of income taxes. Realized gains and losses are determined using the specific-identification method and are

reflected as a component of other income (expense), net in the consolidated statements of operations when they

are realized. When we determine that a decline in fair value is other than temporary, the cost basis of the

individual security is written down to the fair value as a new cost basis and the amount of the write-down is

accounted for as a realized loss in other income (expense), net. The new cost basis will not be adjusted for

subsequent recoveries in fair value. Determination of whether declines in fair value are other than temporary

requires judgment regarding the amount and timing of recovery. No such impairments of marketable securities

have been recorded to date.

For non-marketable securities in which we exercise significant influence on the equity to which these non-

marketable securities relate, we apply the equity method of accounting. Our non-marketable securities are subject

to periodic impairment reviews.

Restricted Cash

Restricted cash consists of collateral for facility operating lease agreements and funds held in escrow in

accordance with the terms of certain of our business acquisition agreements.

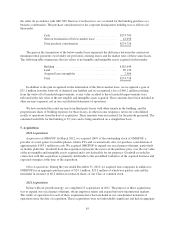

Derivatives and Hedging

We account for derivative financial instruments in accordance with Accounting Standards Codification

(“ASC”) 815, Derivatives and Hedging, which requires that every derivative instrument be recorded on the

balance sheet as either an asset or liability measured at its fair value as of the reporting date. ASC 815 also

requires that changes in our derivatives’ fair values be recognized in earnings, unless specific hedge accounting

and contemporaneous documentation criteria are met, in which case, the change in fair value related to the

effective portion of the hedge may be recognized as a component of accumulated other comprehensive income

(i.e., the instruments qualify for hedge accounting treatment). Any ineffective or excluded portion of a designated

cash flow hedge is recognized in earnings.

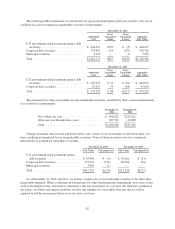

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are recorded and carried at the original invoiced amount less an allowance for any

potential uncollectible amounts. We review accounts receivable regularly and make estimates for the allowance

for doubtful accounts when there is doubt as to our ability to collect individual balances. In evaluating our ability

to collect outstanding receivable balances, we consider many factors, including the age of the balance, the

customer’s payment history and current creditworthiness, and current economic trends. Bad debts are written off

after all collection efforts have ceased. We do not require collateral from our customers.

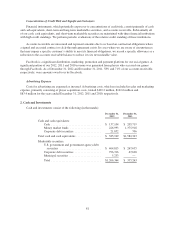

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is recorded using the

straight-line method over the estimated useful lives of the assets. Leasehold improvements are amortized over the

shorter of the estimated useful lives of the improvements or the lease term.

78