Zynga 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Before we began forming non-U.S. operating companies during 2010, the revenue from non-U.S. users was

earned by our U.S. Company, resulting in virtually no foreign profit before tax. The new foreign entities, as start-

up companies, generated operating losses in 2010 and 2011. During 2012, we completed the implementation of

our international structure, which resulted in a significant loss outside of the U.S. During 2012 and 2011, the net

tax impact of the losses generated in tax jurisdictions with lower statutory rates than the U.S. rate increased tax

expense and the effective tax rate.

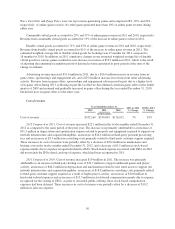

The federal research and development tax credit expired on December 31, 2011. On January 2, 2013, the

American Taxpayer Relief Act of 2012 was signed into law. Under this act, the federal research and development

tax credit was retroactively extended for amounts paid or incurred after December 31, 2011 and before January 1,

2014. The effects of these changes in the tax law will result in a 2012 tax benefit which will be recognized in the

first quarter of 2013, the quarter in which the law was enacted. We estimate our 2012 credit to be between $12

million and $16 million, resulting in a tax benefit of the same amount when recognized in the first quarter.

2011 Compared to 2010. The provision for income taxes decreased by $38.3 million in 2011. This decrease

was attributable to the decrease in pre-tax income from $127 million in the year ended December 31, 2010 to a pre-

tax loss of $406.1 million in 2011. The decrease in pre-tax income was primarily driven by stock-based

compensation expense associated with ZSUs that vested in connection with our initial public offering. In addition,

the income tax benefit associated with the loss generated in 2011 was primarily offset by a valuation allowance.

Before we began forming non-U.S. operating companies during 2010, the revenue from non-U.S. users was

earned by our U.S. company, resulting in virtually no foreign profit before tax. The new foreign entities, as start-

up companies, generated operating losses in 2011 and 2010. The tax impact of the losses generated in tax

jurisdictions with lower statutory rates than the U.S. rate increased tax expense and the effective tax rate.

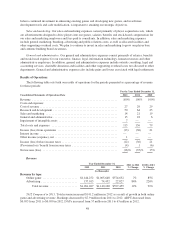

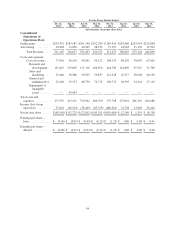

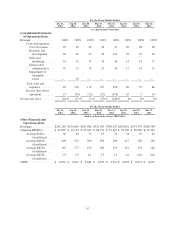

Quarterly Results of Operations Data

The following tables set forth our unaudited quarterly consolidated statements of operations data in dollars

and as a percentage of revenue for each of the eight quarters ended December 31, 2012 (certain items may not

reconcile due to rounding). We also present other financial and operations data, and a reconciliation of revenue to

bookings and net income (loss) to adjusted EBITDA, for the same periods. We have prepared the quarterly

consolidated statements of operations data on a basis consistent with the audited consolidated financial

statements included in this Annual Report on Form 10-K. In the opinion of management, the financial

information reflects all adjustments, consisting only of normal recurring adjustments that we consider necessary

for a fair presentation of this data. This information should be read in conjunction with the audited consolidated

financial statements and related notes included elsewhere in this Annual Report on Form 10-K. The results of

historical periods are not necessarily indicative of the results of operations for a full year or any future period.

53