Zynga 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

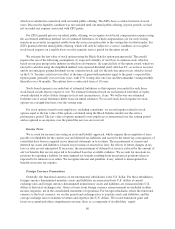

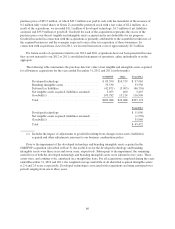

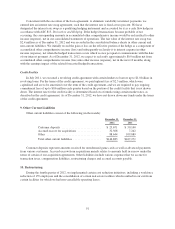

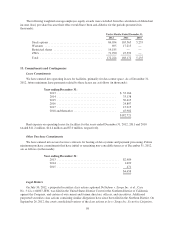

Net operating loss and tax credit carryforwards as of December 31, 2012 are as follows (in thousands):

Amount

Expiration

years

Net operating losses, federal ................. $167,406 2028 - 2032

Net operating losses, state ................... $ 97,462 2021 - 2032

Tax credit, federal ......................... $ 33,966 2020 - 2022

Tax credits, state .......................... $ 33,546 2017 - indefinite

Net operating losses, foreign ................. $ 2,456 2017 - 2019

Tax credits, foreign ........................ $ 46 2017 - 2018

Pursuant to authoritative guidance, the benefit of stock options will only be recorded to stockholders’ equity

when cash taxes payable are reduced. As of December 31, 2012, the portion of net operating loss carryforwards

related to stock options is approximately $178.1 million, the benefit of which will be credited to additional paid-

in capital when realized. The federal and state net operating loss carryforwards are subject to various annual

limitations under Section 382 of the Internal Revenue Code.

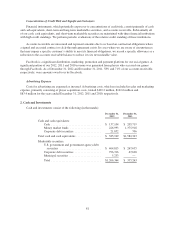

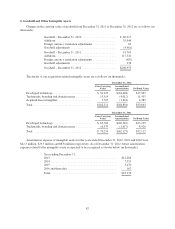

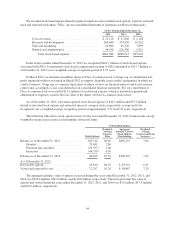

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in thousands):

December 31, 2009 ......................................................... $ 1,528

Additions based on tax positions related to 2010 ............................... 13,782

Reductions for tax positions of prior years ................................... (127)

December 31, 2010 ......................................................... 15,183

Additions based on tax positions related to 2011 ............................... 30,841

Additions for tax positions of prior years .................................... 2,318

Reductions for tax positions of prior years ................................... (9)

December 31, 2011 ......................................................... 48,334

Additions based on tax positions related to 2012 ............................... 51,222

Reductions for tax positions of prior years ................................... (835)

December 31, 2012 ......................................................... $98,721

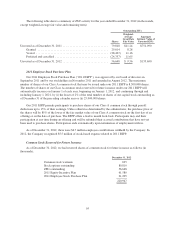

As of December 31, 2012, approximately $66.8 million represents the amount of unrecognized tax benefits

that would, if recognized, impact our effective income tax rate.

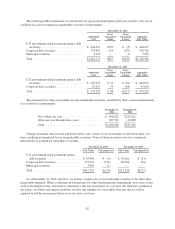

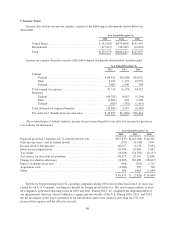

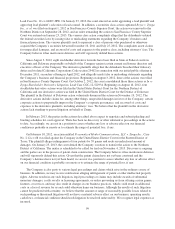

We classify uncertain tax positions as non-current income tax liabilities unless expected to be paid within

one year or otherwise directly related to an existing deferred tax asset, in which case the uncertain tax position is

recorded net of the asset on the balance sheet. These non-current income tax liabilities are classified in other non-

current liabilities on the consolidated balance sheets. We do not anticipate a significant impact to our gross

unrecognized tax benefits within the next 12 months. We recognize interest and penalties in income tax expense.

As of December 31, 2012 and 2011, the total balance of accrued interest and penalties related to uncertain tax

positions was $0.2 million and zero, respectively. We file income tax returns in the United States, including

various state and local jurisdictions. Our subsidiaries file tax returns in various foreign jurisdictions, including

Canada, China, Germany, India, Ireland, Japan, Luxembourg, and UK. We are subject to examination by U.S.

federal, state or foreign tax authorities for all years since 2008.

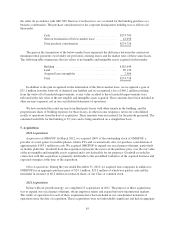

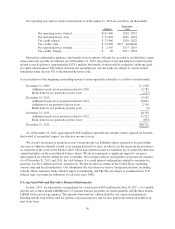

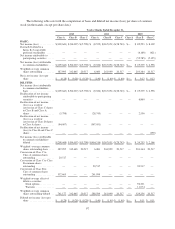

8. Long-term Debt and Derivative Financial Instruments

In June, 2012, we entered into an agreement for a term loan of $100 million due June 30, 2017, at a variable

interest rate of three month LIBOR plus 0.75 percent. Interest payments are made quarterly and the three month

LIBOR will reset once per quarter. The amounts borrowed are collateralized by our corporate headquarters

building and the loan will be used for general corporate purposes and we may prepay the term loan in full or in

part at any time.

90