Zynga 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For our annual impairment analysis performed in the fourth quarter of 2012, our estimates of fair value were

based on the market approach, which estimated the fair value of our reporting unit based on the company’s

market capitalization and an assumed control premium. The result of the impairment analysis showed that the

estimated fair value of the Company exceeded its carrying value. We further corroborated the analysis by

estimating the fair value using the income approach which was based on our estimates of forecasted discounted

cash flows. The results of our analysis using the income approach were consistent with those noted above using

the market approach. Accordingly, we concluded goodwill was not impaired.

Impairment of Long-Lived Assets

Long-lived assets, including other intangible assets (excluding indefinite-lived intangible assets), are

reviewed for impairment whenever events or changes in circumstances indicate an asset’s carrying value may not

be recoverable. If such circumstances are present, we assess the recoverability of the long-lived assets by

comparing the carrying value to the undiscounted future cash flows associated with the related assets. If the

future net undiscounted cash flows are less than the carrying value of the assets, the assets are considered

impaired and an expense, equal to the amount required to reduce the carrying value of the assets to the estimated

fair value, is recorded in the consolidated statements of operations. Significant judgment is required to estimate

the amount and timing of future cash flows and the relative risk of achieving those cash flows.

Assumptions and estimates about future values and remaining useful lives are complex and often subjective.

They can be affected by a variety of factors, including external factors such as industry and economic trends, and

internal factors such as changes in our business strategy and our internal forecasts. For example, if our future

operating results do not meet current forecasts or if we experience a continued decline in our market capitalization,

we may be required to record future impairment charges for goodwill and/or acquired intangible assets. Impairment

charges could materially decrease our future net income and result in lower asset values on our balance sheet.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Interest Rate Fluctuation Risk

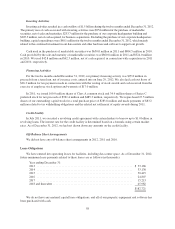

Our cash and cash equivalents and marketable securities consist of cash, money market funds, U.S.

government debt securities and corporate debt securities. The primary objective of our investment activities is to

preserve principal, ensure liquidity and maximize income without significantly increasing risk. Our available-for-

sale investments consist of U.S. government and corporate debt securities which may be subject to market risk

due to changes in prevailing interest rates that may cause the fair values of our investments to fluctuate. Based on

a sensitivity analysis, we have determined that a hypothetical 100 basis points increase in interest rates would

have resulted in a decrease in the fair values of our investments of approximately $8.6 million as of

December 31, 2012. Such losses would only be realized if we sold the investments prior to maturity.

Foreign Currency Exchange Risk

Our sales transactions are primarily denominated in U.S. dollars and therefore substantially all of our

revenue is not subject to foreign currency risk. However, certain of our operating expenses are incurred outside

the United States and are denominated in foreign currencies and are subject to fluctuations due to changes in

foreign currency exchange rates, particularly changes in the Euro, Chinese Yuan, Japanese Yen, British Pound,

Canadian Dollar and Indian Rupee. The volatility of exchange rates depends on many factors that we cannot

forecast with reliable accuracy. Although we have experienced and will continue to experience fluctuations in

our net income (loss) as a result of transaction gains (losses) related to revaluing certain cash balances, trade

accounts receivable, trade accounts payable, current liabilities and intercompany balances that are denominated

in currencies other than the U.S. dollar, we believe such a change would not have a material impact on our results

of operations.

63