Zynga 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.partnership with Hasbro that grants them the rights to develop a wide range of toy and gaming

experiences based on Zynga’s social games and brands.

•Stock Repurchase Program. In October 2012, our Board authorized a $200 million stock repurchase

program. We initiated purchases under this program in December 2012. As of December 31, 2012, we

had spent a total of $11.8 million under our stock repurchase program to repurchase 5.0 million shares

of our Class A common stock at an average price of $2.36 per share; the remaining authorized amount

of stock repurchases that may be made under this plan was $188.2 million.

Factors Affecting Our Performance

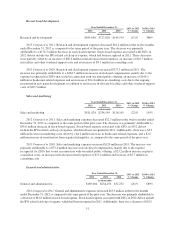

Changes in Facebook Agreements. Facebook is the primary distribution, marketing, promotion and payment

platform for our social games. We generate a significant portion of our bookings, revenue and players through

the Facebook platform and expect to continue to do so for the foreseeable future. Facebook and other platforms

generally have the discretion to change their platforms, terms of service and other policies with respect to us or

other developers, and those changes may be unfavorable to us. On November 28, 2012, we amended our

agreements with Facebook such that our use of the Facebook platform and any data from Facebook on any Zynga

service offered through a Zynga game page (for example, the With Friends Network) will be governed by

Facebook’s standard terms of service beginning on March 31, 2013. Under the current terms of service, we will

be limited in our ability to use a Facebook user’s friends list and Facebook’s communication channels to promote

the With Friends Network. In December 2012, Facebook amended its standard terms of service to prohibit

(i) apps on the Facebook canvas from promoting or linking to game sites other than Facebook and (ii) the use of

emails obtained from Facebook to promote or link to desktop web games on platforms other than Facebook. We

will be prohibited from cross-promoting traffic to games that are offered on platforms other than Facebook from

our games on Facebook. We will not be permitted to use e-mail addresses obtained from Facebook to promote

desktop web games that are not on the Facebook platform, subject to certain limited exceptions. Beginning on

March 31, 2013, we will no longer be obligated to display Facebook advertising units or utilize Facebook’s

payment services (Facebook Credits and/or local-currency based payments) on any such Zynga game pages. We

will have the right to process our own payments, and Facebook will no longer have the right to receive 30% of

the proceeds from payments made on the With Friends Network.

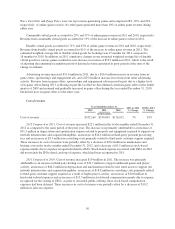

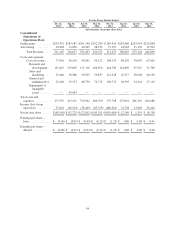

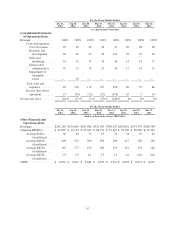

Launch of new games and release of enhancements. Our bookings and revenue results have been driven by

the launch of new games and the release of fresh content and new features in existing games. Although the

amount of revenue and bookings we generate from a new game or an enhancement to an existing game can vary

significantly, we expect our revenue and bookings to be correlated to the success and timely launch of our new

games and our success in releasing engaging content and features.

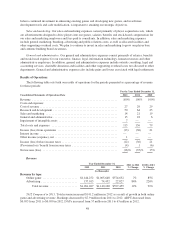

Game monetization. We generate most of our bookings and revenue from the sale of virtual goods in our

games. The degree to which our players choose to pay for virtual goods in our games is driven by our ability to

create content and virtual goods that enhance the game-play experience. Our bookings, revenue and overall

financial performance are affected by the number of players and the effectiveness of our monetization of players

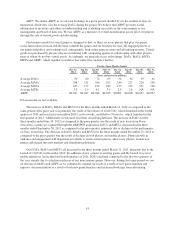

through the sale of virtual goods and advertising. For example ABPU decreased from $0.055 in the twelve

months ended December 31, 2011 to $0.050 in the twelve months ended December 31, 2012, which was partially

due to a shift in our user base to mobile games including Draw Something, a mobile game that increased our

overall player base, but did not monetize as high as some of our core web games. In addition, mobile and

international players have historically monetized at a lower level than U.S. players on average. The percentage of

paying mobile and international players may increase or decrease based on a number of factors, including growth

in mobile games as a percentage of total game audience and our overall international players, localization of

content and the availability of payment options.

Investment in game development. In order to develop new games and enhance the content and features in

our existing games, we must invest in a significant amount of engineering and creative resources. These

46