Zynga 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenditures generally occur months in advance of the launch of a new game or the release of new content, and

the resulting revenue may not equal or exceed our development costs.

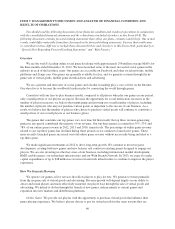

Player acquisition costs. We utilize advertising and other forms of player acquisition and retention to grow

and retain our player audience. These expenditures generally relate to the promotion of new game launches and

ongoing performance-based programs to drive new player acquisition and lapsed player reactivation. Over time,

these acquisition and retention-related programs may become either less effective or more costly, negatively

impacting our operating results. Due to the amendment of our agreement with Facebook, effective March 31,

2013, we may incur increased player acquisition costs as our ability to cross-promote traffic to games that are

offered on platforms other than Facebook, for example, games offered on our With Friends Network, as well as

our RMG offerings with bwin.party, will be limited by Facebook’s standard terms of service, subject to certain

exceptions.

New market development. We are investing in new distribution channels such as the With Friends Network,

mobile platforms, other social networks and international markets to expand our reach and grow our business.

For example, we have continued to hire additional employees and acquire companies with experience developing

mobile applications. We have also invested resources in integrating and operating some of our games on

additional platforms, including Google+, mixi, Tencent, and our With Friends Network. Our ability to be

successful will depend on our ability to obtain users on our With Friends Network , interest third-party game

developers, attract advertisers and successfully extend our With Friends Network to mobile.

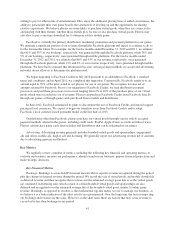

During 2012, we expanded our efforts into RMG markets by entering into an agreement with bwin.party to

offer RMG products in the UK and filing an application for Preliminary Finding of Suitability with the Nevada

Gaming Control Board. We will continue to explore RMG options in regulated markets as well as take actions in

preparation for potential legislative developments.

As we expand into new markets and distribution channels, we expect to incur headcount, marketing and

other operating costs in advance of the associated bookings and revenue. Our financial performance will be

impacted by our investment in these initiatives and their success.

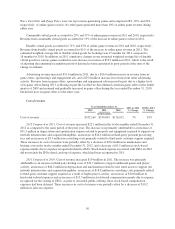

Stock-based expense. Prior to our initial public offering, we granted ZSUs to our employees that generally

vested upon the satisfaction of both a service-period condition of up to four years and a liquidity event condition,

the latter of which was satisfied upon our initial public offering. Because the liquidity event condition was not

met until our initial public offering, prior to the fourth quarter of 2011, we had not recorded any expense related

to our ZSUs. In the twelve months ended December 31, 2012, we recognized $204.7 million, of stock-based

expense related to ZSUs.

Hiring and retaining key personnel. Our ability to compete and grow depends in large part on the efforts and

talents of our employees. During 2012, we experienced increased employee attrition. Retaining key employees is

critical to our ability to grow our business and execute on our business strategy.

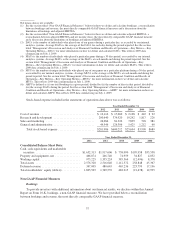

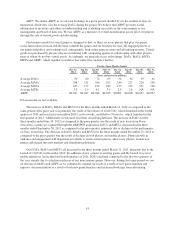

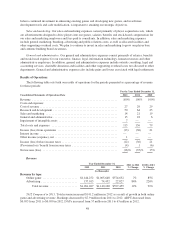

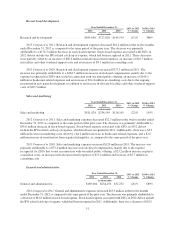

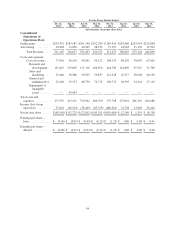

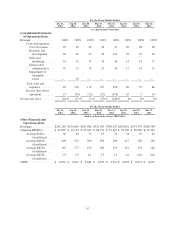

Cost of Revenue and Operating Expenses

Cost of revenue. Our cost of revenue consists primarily of web hosting and data center costs related to

operating our games, including: depreciation and amortization; consulting costs primarily related to third-party

provisioning of customer support services; certain payment processing fees, and salaries, benefits and stock-

based expense for our customer support and infrastructure teams. Our infrastructure team includes our network

operations and payment platform teams. Credit card processing fees, allocated facilities costs and other

supporting overhead costs are also included in cost of revenue.

Research and development. Our research and development expenses consist primarily of salaries, benefits

and stock-based expense for our engineers and developers. In addition, research and development expenses

include outside services and consulting, as well as allocated facilities and other supporting overhead costs. We

47