Zynga 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Zynga Inc.

Notes to Consolidated Financial Statements

1. Overview and Summary of Significant Accounting Policies

Organization and Description of Business

Zynga Inc. (“Zynga,” “we” or “the Company”) develops, markets and operates online social games as live

services played over the Internet and on social networking sites and mobile platforms. We generate revenue

through the in-game sale of virtual goods and through advertising. Our operations are headquartered in San

Francisco, California, and we have several operating locations in the U.S. as well as various international office

locations in Canada, Asia and Europe.

We were originally organized in April 2007 as a California limited liability company under the name

Presidio Media LLC, converted to a Delaware corporation under the name Zynga Game Network Inc. in October

2007 and changed our name to Zynga Inc. in November 2010. We completed our initial public offering in

December 2011 and our Class A common stock is listed on the NASDAQ Global Select Market under the

symbol “ZNGA.”

Basis of Presentation and Consolidation

The accompanying consolidated financial statements are presented in accordance with United States

generally accepted accounting principles (“U.S. GAAP”). The consolidated financial statements include the

operations of us and our wholly-owned subsidiaries. All significant intercompany balances and transactions have

been eliminated in the consolidation.

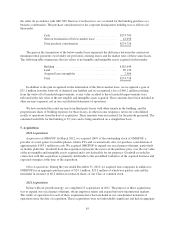

Initial Public Offering

On December 15, 2011, we completed our initial public offering in which we issued and sold 100 million

shares of Class A common stock at a public offering price of $10.00 per share. We raised a total of $961.4

million of net proceeds after deducting underwriter discounts and commissions of $32.5 million and other

offering expenses of $6.1 million. Upon the closing of the initial public offering, all shares of the Company’s

then-outstanding convertible preferred stock automatically converted into an aggregate of 304.9 million shares of

Class B common stock. Additionally, 15.7 million vested ZSUs, after deducting shares withheld to satisfy

minimum tax withholding obligations, were automatically converted into Class B common shares.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make

estimates and assumptions that affect the reported amounts in the consolidated financial statements and notes

thereto. Significant estimates and assumptions reflected in the financial statements include, but are not limited to,

the estimated lives of virtual goods that we use for revenue recognition, useful lives of intangible assets, accrued

liabilities, income taxes, accounting for business combinations, stock-based expense and evaluation of goodwill,

intangible assets, and long-lived assets for impairment. Actual results could differ materially from those

estimates.

Segments

We have one operating segment with one business activity, developing and monetizing social games. Our

Chief Operating Decision Maker (CODM), our Chief Executive Officer, manages our operations on a

consolidated basis for purposes of allocating resources. When evaluating performance and allocating resources,

the CODM reviews financial information presented on a consolidated basis, accompanied by disaggregated

bookings information for our games.

75