Zynga 2012 Annual Report Download - page 91

Download and view the complete annual report

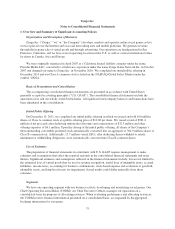

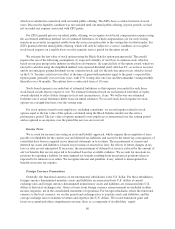

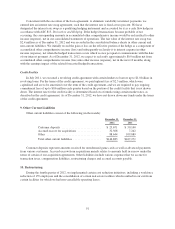

Please find page 91 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Fair Value Measurements

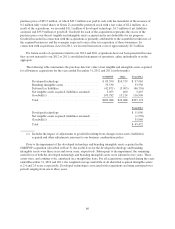

Our financial instruments consist of cash equivalents, short-term and long-term marketable securities,

accounts receivable, long-term debt and an interest rate swap. Accounts receivable, net and long-term debt are

stated at their carrying value, which approximates fair value.

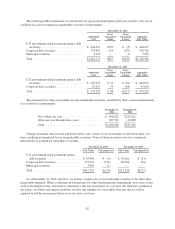

Cash equivalents and short-term and long-term marketable securities, consisting of money market funds,

U.S. government and government agency debt securities, municipal securities and corporate debt securities, are

carried at fair value, which is defined as an exit price, representing the amount that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between knowledgeable and willing market

participants. These valuation techniques involve some level of management estimation and judgment, the degree

of which is dependent on price transparency for the instruments or market and the instruments’ complexity.

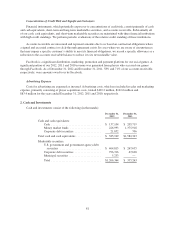

We determine the fair value of our interest rate swap by calculating the net present value of the fixed and

variable future cash flows of the swap agreement, which are based on the swap’s stated rate and current market

interest rates, respectively.

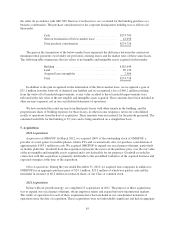

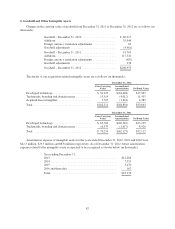

Our non-financial assets, such as intangible assets and property, plant and equipment, are recorded at

carrying value unless we recognize an impairment charge and adjust the asset to its fair value. In the third quarter

of 2012, we made the decision to discontinue development of certain games associated with technology and other

intangible assets previously acquired from OMGPOP. Our updated financial forecast as of September 30, 2012

indicated a reduction of undiscounted cash flows expected to be generated from these intangible assets, and we

therefore performed an impairment analysis. We determined the estimated fair value of these assets to be

$95.5 million lower than their carrying value as of September 30, 2012. Accordingly, we recorded this amount as

an impairment charge in our consolidated statements of operations and stated the related OMGPOP intangibles at

their fair value of $5.3 million on our consolidated balance sheets as of September 30, 2012. The impaired

intangible assets were classified as Level 3 assets within the fair value hierarchy on September 30, 2012 due to

the unobservable inputs that were factored into our income-based valuation analysis used to determine their fair

value at the time. The primary input used in determining the fair value of the intangible assets was the estimated

undiscounted future cash flows associated with those assets as of September 30, 2012. As of December 31, 2012,

there were no further indicators of impairment related to the OMGPOP intangibles and they were stated at their

adjusted amortized basis of $4.6 million within our consolidated balance sheets.

Fair value is a market-based measurement that should be determined based on assumptions that

knowledgeable and willing market participants would use in pricing an asset or liability. We use a three-tier

value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1 — Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in

active markets.

Level 2 — Includes inputs, other than Level 1 inputs, that are directly or indirectly observable in the

marketplace.

Level 3 — Unobservable inputs that are supported by little or no market activity.

83