Zynga 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

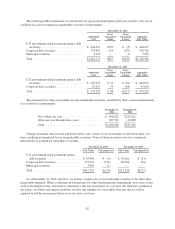

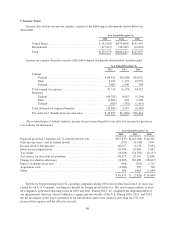

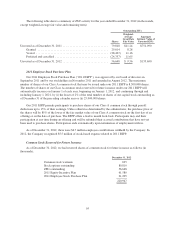

the seller. In accordance with ASC 805, Business Combinations, we accounted for the building purchase as a

business combination. The purchase consideration for the corporate headquarters building was as follows (in

thousands):

Cash ............................................ $233,700

Gain on termination of below-market lease .............. 41,058

Total purchase consideration ......................... $274,758

The gain on the termination of the below-market lease represents the difference between the contractual

minimum rental payments owed under our previously-existing leases and the market rates of those same leases.

The following table summarizes the fair values of net tangible and intangible assets acquired (in thousands):

Building ......................................... $182,644

Land ............................................ 89,130

Acquired lease intangibles ........................... 2,984

Total ............................................ $274,758

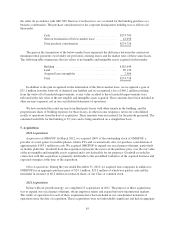

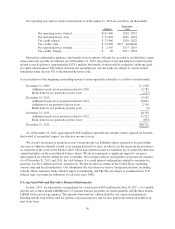

In addition to the gain recognized on the termination of the below-market lease, we recognized a gain of

$25.1 million from the write-off of deferred rent liability and we recognized a loss of $46.2 million resulting

from the write-off of leasehold improvements, as any value ascribed to these leasehold improvements were

reflected in the fair value of the net tangible and intangible assets acquired. These amounts have been included in

other income (expense), net in our consolidated statements of operations.

We have included the rental income from third party leases with other tenants in the building, and the

proportionate share of building expenses for those leases, in other income (expense), net in our consolidated

results of operations from the date of acquisition. These amounts were not material for the periods presented. The

estimated useful life for the building is 39 years and is being amortized on a straight-line basis.

5. Acquisitions

2012 Acquisitions

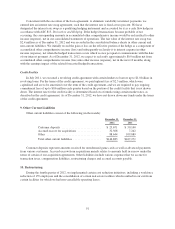

Acquisition of OMGPOP. In March 2012, we acquired 100% of the outstanding stock of OMGPOP, a

provider of social games for mobile phones, tablets, PCs and social network sites, for purchase consideration of

approximately $183.1 million in cash. We acquired OMGPOP to expand our social games offerings, particularly

on mobile platforms. Goodwill from the acquisition represents the excess of the purchase price over the fair value

of the net tangible and intangible assets acquired and is not deductible for tax purposes. Goodwill recorded in

connection with this acquisition is primarily attributable to the assembled workforce of the acquired business and

expected synergies at the time of the acquisition.

Other Acquisitions. During the year ended December 31, 2012, we acquired four companies in addition to

OMGPOP for an aggregate purchase price of $24.1 million, $23.9 million of which was paid in cash and the

remainder in issuance of $0.2 million in restricted shares of our Class A common stock.

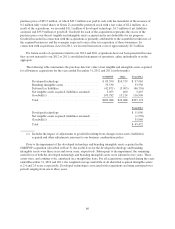

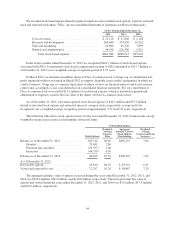

2011 Acquisitions

In line with our growth strategy, we completed 15 acquisitions in 2011. The purpose of these acquisitions

was to expand our social games offerings, obtain employee talent, and expand into new international markets.

The results of operations for each of these acquisitions have been included in our consolidated statement of

operations since the date of acquisition. These acquisitions were not individually significant and had an aggregate

85