Zynga 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

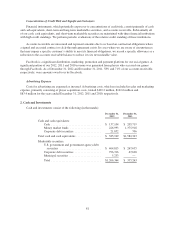

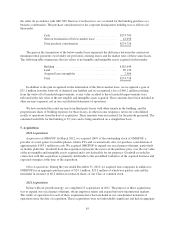

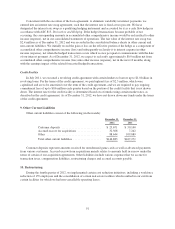

Concentration of Credit Risk and Significant Customers

Financial instruments, which potentially expose us to concentrations of credit risk, consist primarily of cash

and cash equivalents, short-term and long-term marketable securities, and accounts receivable. Substantially all

of our cash, cash equivalents, and short-term marketable securities are maintained with three financial institutions

with high credit standings. We perform periodic evaluations of the relative credit standing of these institutions.

Accounts receivable are unsecured and represent amounts due to us based on contractual obligations where

a signed and executed contract or click-through agreement exists. In cases where we are aware of circumstances

that may impair a specific customer’s ability to meet its financial obligations, we record a specific allowance as a

reduction to the accounts receivable balance to reduce it to its net realizable value.

Facebook is a significant distribution, marketing, promotion and payment platform for our social games. A

significant portion of our 2012, 2011 and 2010 revenue was generated from players who accessed our games

through Facebook. As of December 31, 2012 and December 31, 2011, 58% and 71% of our accounts receivable,

respectively, were amounts owed to us by Facebook.

Advertising Expense

Costs for advertising are expensed as incurred. Advertising costs, which are included in sales and marketing

expense, primarily consisting of player acquisition costs, totaled $102.2 million, $102.6 million and

$83.4 million for the years ended December 31, 2012, 2011 and 2010, respectively.

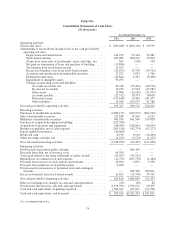

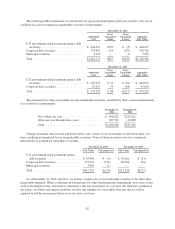

2. Cash and Investments

Cash and investments consist of the following (in thousands):

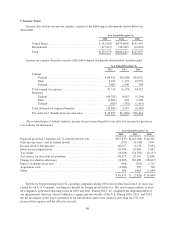

December 31,

2012

December 31,

2011

Cash and cash equivalents:

Cash .................................. $ 137,104 $ 205,719

Money market funds ..................... 226,993 1,375,918

Corporate debt securities .................. 21,852 706

Total cash and cash equivalents ................. $ 385,949 $1,582,343

Marketable securities:

U.S. government and government agency debt

securities ............................ $ 464,815 $ 267,635

Corporate debt securities .................. 796,316 67,628

Municipal securities ...................... 5,233 —

Total .................................. $1,266,364 $ 335,263

81