Zynga 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.regulatory, operational, financial and economic risks, any of which could increase our costs and hinder

such growth” elsewhere in this Annual Report on Form 10-K;

• in the case of foreign acquisitions, the need to integrate operations across different cultures and

languages and to address the particular economic, currency, political and regulatory risks associated

with specific countries;

• in some cases, the need to transition operations and players onto our existing or new platforms and the

potential loss of, or harm to, our relationships with employees, players and other suppliers as a result of

integration of new businesses; and

• liability for activities of the acquired company before the acquisition, including intellectual property

and other litigation claims or disputes, information security vulnerabilities, violations of laws, rules and

regulations, commercial disputes, tax liabilities and other known and unknown liabilities.

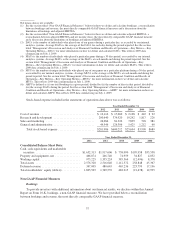

The benefits of an acquisition or investment may also take considerable time to develop, and we cannot be

certain that any particular acquisition or investment will produce the intended benefits, which could adversely

affect our business and operating results. Acquisitions could result in potential dilutive issuances of equity

securities, use of significant cash balances or incurrence of debt (and increased interest expense), contingent

liabilities or amortization expenses related to intangible assets or write-offs of goodwill and/or intangible assets,

which could adversely affect our results of operations and dilute the economic and voting rights of our

stockholders. For example, in the third quarter of 2012, we made the decision to discontinue the development of

certain games associated with technology and other intangible assets previously acquired from OMGPOP and we

recorded an asset impairment charge of $95.5 million. For more information, see Note 6 — “Goodwill and Other

Intangible Assets” in the notes to the consolidated financial statements included elsewhere in this Annual Report

on Form 10-K.

Failure in pursuing or executing new business initiatives, including RMG, could have a material adverse

impact on our business and future growth.

Our growth strategy includes evaluating, considering and effectively executing new business initiatives,

which can be difficult. Management may not properly ascertain or assess the risks of new initiatives, and

subsequent events may alter the risks that were evaluated at the time we decided to execute any new initiative.

Entering into any new initiatives can also divert our management’s attention from other business issues and

opportunities. Failure to effectively identify, pursue and execute new business initiatives, including RMG as

discussed below, may adversely affect our reputation, business, financial condition and results of operations. We

believe RMG could have risks that are different than those associated with other new initiatives. In particular,

RMG is subject to stringent, complicated and rapidly changing licensing and regulatory requirements, both

federally and in each state, as well as internationally. Regulatory and legislative developments, including

excessive taxation, may prevent or significantly limit our ability to enter into or succeed in RMG. Becoming

familiar with and complying with these requirements will increase our costs and subject our business to greater

scrutiny by regulators in many different jurisdictions. If our brand becomes associated with RMG we may lose

current players, advertisers or partners or have difficulty attracting new players, advertisers or partners, which

could adversely impact our business.

We have begun efforts to expand our business to include RMG and in October 2012, we entered into a

partnership agreement with bwin.party digital entertainment plc to develop, test and operate certain real money

online poker and casino games in the United Kingdom. This is our first experience with RMG and we cannot

assure you that these preliminary efforts will be successful or result in the development or timely launch of RMG

products, if at all, or ultimately produce any revenue. In addition, even if we ultimately do launch RMG products,

if we or our partners fail to comply with regulatory requirements, or if players are less satisfied than expected

with the games provided, or if we become subject to excessive taxation in the U.S. or in other countries, we may

not realize the anticipated benefits of this line of business or we may lose players and we may curtail our efforts

to enter the RMG market.

27