Zynga 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

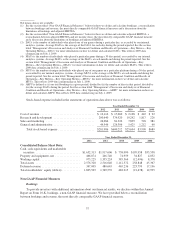

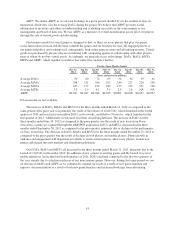

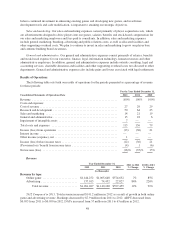

The following table presents a reconciliation of net income (loss) to adjusted EBITDA for each of the

periods indicated:

Year Ended December 31,

2012 2011 2010 2009 2008

Reconciliation of Net Income (Loss) to Adjusted

EBITDA:

Net income (loss) ............................ $(209,448) $(404,316) $ 90,595 $ (52,822) $(22,115)

(Provision for) / benefit from income taxes ........ 49,873 (1,826) 36,464 12 38

Other income (expense), net ................... (18,647) 2,206 (365) 209 (187)

Interest income .............................. (4,749) (1,680) (1,222) (177) (319)

Gain (loss) from legal settlements ............... 3,024 (2,145) (39,346) — 7,000

Depreciation and amortization .................. 141,479 95,414 39,481 10,372 2,905

Stock-based expense ......................... 281,986 600,212 25,694 3,990 689

Impairment of intangible assets ................. 95,493 — — — —

Restructuring expense ........................ 7,862 — — — —

Change in deferred revenue .................... (133,640) 15,409 241,437 206,603 16,538

Adjusted EBITDA ........................... $213,233 $ 303,274 $392,738 $168,187 $ 4,549

Limitations of Bookings and Adjusted EBITDA

Some limitations of bookings and adjusted EBITDA are:

• adjusted EBITDA does not include the impact of stock-based expense;

• bookings and adjusted EBITDA do not reflect that we defer and recognize online game revenue and

revenue from certain advertising transactions over the estimated average life of virtual goods or as

virtual goods are consumed;

• adjusted EBITDA does not reflect income tax expense;

• adjusted EBITDA does not include other income and expense (net), which includes foreign exchange

gains and losses, interest income, and the net gain on termination of our lease and the purchase of our

corporate headquarters building;

• adjusted EBITDA excludes depreciation and amortization and although these are non-cash charges, the

assets being depreciated and amortized may have to be replaced in the future;

• adjusted EBITDA does not include the impairment of intangible assets previously acquired in

connection with the company’s purchase of OMGPOP;

• adjusted EBITDA does not include losses associated with restructuring charges;

• adjusted EBITDA does not include gains and losses associated with legal settlements; and

• other companies, including companies in our industry, may calculate bookings and adjusted EBITDA

differently or not at all, which reduces their usefulness as a comparative measure.

Because of these limitations, you should consider bookings and adjusted EBITDA along with other financial

performance measures, including revenue, net income (loss) and our other financial results presented in

accordance with U.S. GAAP.

39