Zynga 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which was satisfied in connection with our initial public offering. The ZSUs have a contractual term of seven

years. Because the liquidity condition was not satisfied until our initial public offering, in prior periods, we had

not recorded any expense associated with ZSU grants.

For ZSUs granted prior to our initial public offering, we recognize stock-based compensation expense using

the accelerated attribution method, net of estimated forfeitures, in which compensation cost for each vesting

tranche in an award is recognized ratably from the service inception date to the vesting date for that tranche. For

ZSUs granted after the initial public offering, which will only be subject to a service condition, we recognize

stock-based expense on a ratable basis over the requisite service period for the entire award.

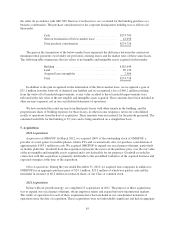

We estimate the fair value of stock options using the Black-Scholes option-pricing model. This model

requires the use of the following assumptions: (i) expected volatility of our Class A common stock, which is

based on our peer group in the industry in which we do business; (ii) expected life of the option award, which we

elected to calculate using the simplified method; (iii) expected dividend yield, which is 0%, as we have not paid

and do not anticipate paying dividends on our common stock; and (iv) the risk-free interest rate, which is based

on the U.S. Treasury yield curve in effect at the time of grant with maturities equal to the grant’s expected life.

Option grants generally vest over four years, with 25% vesting after one year and the remainder vesting monthly

thereafter over 36 months. The options have a contractual term of 10 years.

Stock-based expense is recorded net of estimated forfeitures so that expense is recorded for only those

stock-based awards that we expect to vest. We estimate forfeitures based on our historical forfeiture of equity

awards adjusted to reflect future changes in facts and circumstances, if any. We will revise our estimated

forfeiture rate if actual forfeitures differ from our initial estimates. We record stock-based expense for stock

options on a straight-line basis over the vesting term.

For stock options issued to non-employees, including consultants, we record expense related to stock

options equal to the fair value of the options calculated using the Black-Scholes model over the service

performance period. The fair value of options granted to non-employees is remeasured over the vesting period

and recognized as an expense over the period the services are received.

Income Taxes

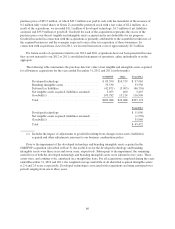

We account for income taxes using an asset and liability approach, which requires the recognition of taxes

payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of

events that have been recognized in our financial statements or tax returns. The measurement of current and

deferred tax assets and liabilities is based on provisions of enacted tax laws; the effects of future changes in tax

laws or rates are not anticipated. If necessary, the measurement of deferred tax assets is reduced by the amount of

any tax benefits that are not expected to be realized based on available evidence. We account for uncertain tax

positions by reporting a liability for unrecognized tax benefits resulting from uncertain tax positions taken or

expected to be taken in a tax return. We recognize interest and penalties, if any, related to unrecognized tax

benefits in income tax expense.

Foreign Currency Transactions

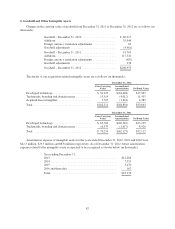

Generally, the functional currency of our international subsidiaries is the U.S. dollar. For these subsidiaries,

foreign currency denominated monetary assets and liabilities are remeasured into U.S. dollars at current

exchange rates and foreign currency denominated nonmonetary assets and liabilities are remeasured into U.S.

dollars at historical exchange rates. Gains or losses from foreign currency remeasurement are included in other

income (expense), net in the consolidated statements of operations. For foreign subsidiaries where the functional

currency is the local currency, we use the period-end exchange rates to translate assets and liabilities, and the

average exchange rates to translate revenues and expenses into U.S. dollars. We record translation gains and

losses in accumulated other comprehensive income (loss) as a component of stockholders’ equity.

80