Zynga 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

purchase price of $45.5 million, of which $43.3 million was paid in cash with the remainder of the issuance of

0.2 million fully vested shares of Series Z convertible preferred stock with a fair value of $2.2 million. As a

result of the acquisitions, we recorded $11.1 million of developed technology, $1.5 million of net liabilities

assumed, and $35.9 million of goodwill. Goodwill for each of the acquisitions represents the excess of the

purchase price over the net tangible and intangible assets acquired and is not deductible for tax purposes.

Goodwill recorded in connection with the acquisitions is primarily attributable to the assembled workforces of

the acquired businesses and the synergies expected to arise after our acquisition of those businesses. In

connection with acquisitions closed in 2011, we incurred transaction costs of approximately $2.3 million.

Pro forma results of operations related to our 2012 and 2011 acquisitions have not been presented because

they are not material to our 2012 or 2011 consolidated statements of operations, either individually or in the

aggregate.

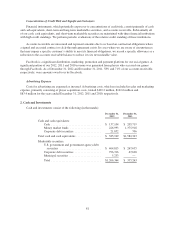

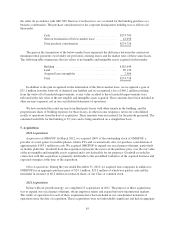

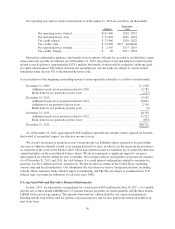

The following table summarizes the purchase date fair value of net tangible and intangible assets acquired

for all business acquisitions for the years ended December 31, 2012 and 2011 (in thousands):

OMGPOP Other Total 2012

Developed technology .......................... $ 83,590 $14,379 $ 97,969

Branding intangible assets ....................... 33,530 — 33,530

Deferred tax liabilities .......................... (42,871) (3,905) (46,776)

Net tangible assets acquired (liabilities assumed) ..... 5,055 400 5,455

Goodwill(1) .................................. 103,782 13,214 116,996

Total ........................................ $183,086 $24,088 $207,174

Total 2011

Developed technology .......................... $ 11,056

Net tangible assets acquired (liabilities assumed) ..... (1,530)

Goodwill(1) .................................. 35,946

Total ........................................ $ 45,472

(1) Includes the impact of adjustments to goodwill resulting from changes in net assets (liabilities)

acquired and other adjustments, pursuant to our business combinations policy.

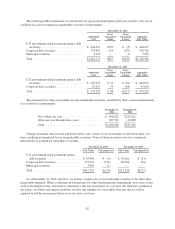

Prior to the impairment of the developed technology and branding intangible assets acquired in the

OMGPOP acquisition (described in Note 3), the useful lives for the developed technology and branding

intangible assets were three years and seven years, respectively. Subsequent to the impairment, the remaining

useful lives of both the developed technology and branding intangible assets were adjusted to two years. These

assets were, and continue to be, amortized on a straight-line basis. For all acquisitions completed during the years

ended December 31, 2012 and 2011, the weighted-average useful life of all identified acquired intangible assets

is 2.4 and 2.0 years, respectively. Developed technologies associated with acquisitions are being amortized over

periods ranging from one to three years.

86