Zynga 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

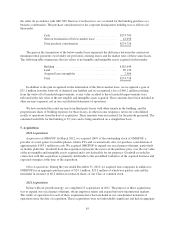

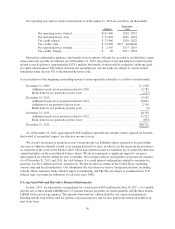

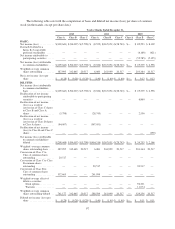

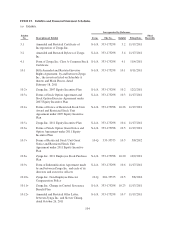

We recorded stock-based expense related to grants of employee and consultant stock options, warrants, restricted

stock and restricted stock units (“ZSUs”) in our consolidated statements of operations as follows (in thousands):

Twelve Months Ended December 31,

2012 2011 2010

Cost of revenue ................................ $ 12,116 $ 17,660 $ 2,128

Research and development ....................... 200,640 374,920 10,242

Sales and marketing ............................ 24,684 81,326 7,899

General and administrative ...................... 44,546 126,306 5,425

Total stock-based expense ................... $281,986 $600,212 $25,694

In the twelve months ended December 31, 2012 we recognized $204.7 million of stock-based expense

associated with ZSUs. Unamortized stock-based compensation relating to ZSUs amounted to $312.7 million as

of December 31, 2012 over a weighted-average recognition period of 2.72 years.

In March 2012, we donated one million shares of Class A common stock to Zynga.org, an unaffiliated non-

profit organization that was formed in March 2012 to support charitable causes in the communities in which we

conduct business. Zynga.org is a separate legal entity in which we have no financial interest and do not exercise

control and, accordingly, is not consolidated in our consolidated financial statements. For our contribution of

Class A common stock we recorded $13.1 million of stock-based expense, which is included in general and

administrative expenses, equal to the fair value of the shares of Class A common stock issued.

As of December 31, 2012, total unrecognized stock-based expense of $44.3 million and $35.3 million

related to unvested stock options and restricted shares of common stock, respectively, is expected to be

recognized over a weighted-average recognition period of approximately 3.27 and 2.74 years, respectively.

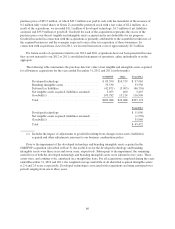

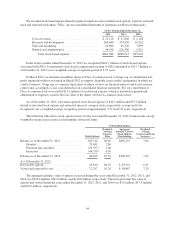

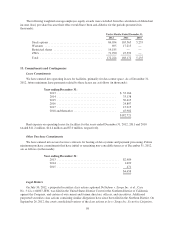

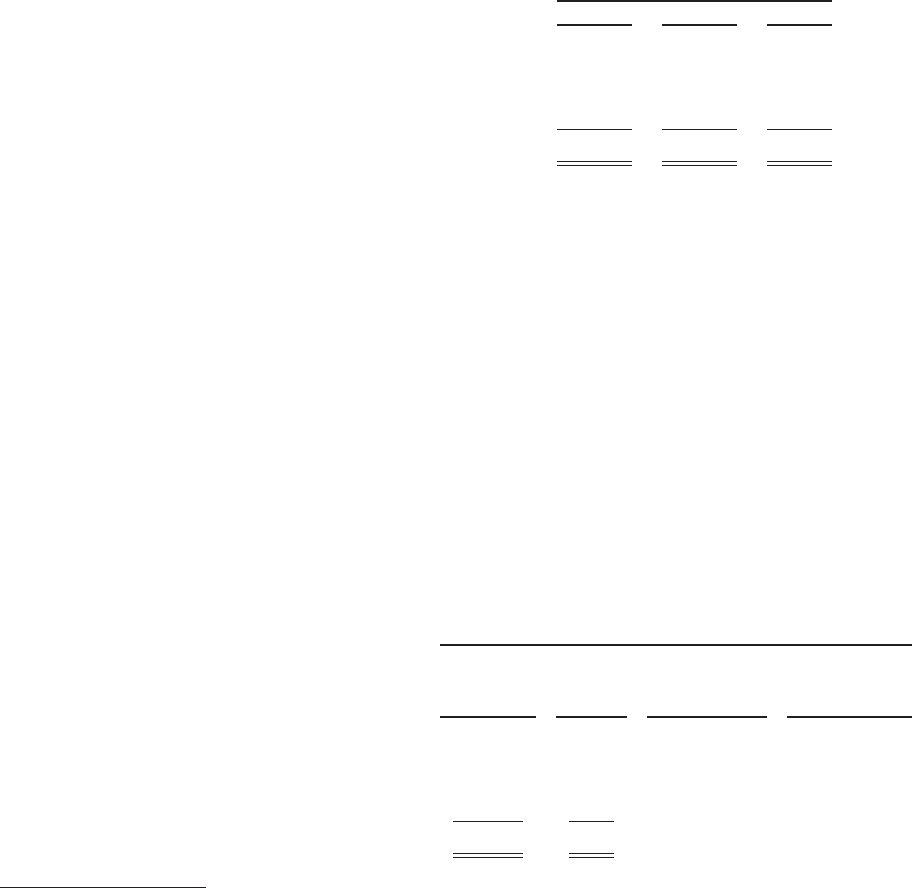

The following table shows stock option activity for the year ended December 31, 2012 (in thousands, except

weighted-average exercise price and remaining contractual term):

Outstanding Options

Stock Options

Weighted-

Average

Exercise

Price

Aggregate

Intrinsic Value of

Stock Options

Outstanding

Weighted-

Average

Contractual Term

(in years)

Balance as of December 31, 2011 .............. 102,314 $0.69 $892,135 7.04

Granted ............................... 29,401 2.80

Forfeited and cancelled ................... (10,337) 1.48

Exercised .............................. (40,559) 0.36

Balance as of December 31, 2012 .............. 80,819 $1.52 $100,225 7.43

As of December 31, 2012

Exercisable options .......................... 43,810 $0.53 $ 85,591 6.31

Vested and expected to vest ................... 72,297 $1.20 $ 98,867 7.29

The aggregate intrinsic value of options exercised during the years ended December 31, 2012, 2011, and

2010 was $222.4 million, $78.2 million, and $110.6 million, respectively. The total grant date fair value of

options that vested during the years ended December 31, 2012, 2011, and 2010 was $7.6 million, $17.5 million

and $12.9 million, respectively.

94