Zynga 2012 Annual Report Download - page 100

Download and view the complete annual report

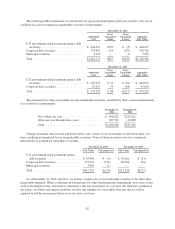

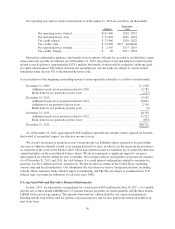

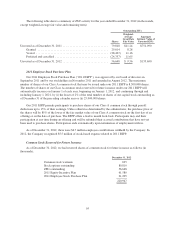

Please find page 100 of the 2012 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the year ended December 31, 2012, we recorded $7.9 million in restructuring charges in operating

expenses within our consolidated statement of operations, which includes employee severance costs of

$7.0 million and other expenses of $0.9 million. The restructuring charges above do not include the impact of

$6.9 million of stock-based expense reversals associated with employee terminations as a result of our

restructuring, which were recognized in operating expenses within our consolidated statements of operations.

In the first half of 2013, we expect to incur approximately an additional $2 million of restructuring expense

related to our 2012 restructuring.

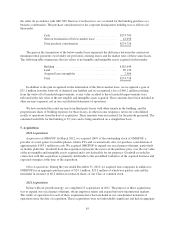

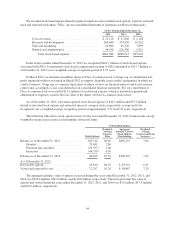

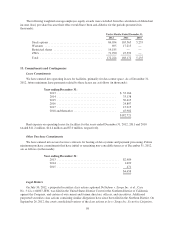

11. Stockholders’ Equity

Common Stock

Our three classes of common stock are Class A common stock, Class B common stock and Class C common

stock. The following are the rights and privileges of our classes of common stock:

Dividends. The holders of outstanding shares of our Class A, Class B and Class C common stock are

entitled to receive dividends out of funds legally available at the times and in the amounts that our board of

directors may determine.

Voting Rights. Holders of our Class A common stock are entitled to one vote per share, holders of our Class

B common stock are entitled to seven votes per share and holders of our Class C common stock are entitled to 70

votes per share. In general, holders of our Class A common stock, Class B common stock and Class C common

stock will vote together as a single class on all matters submitted to a vote of stockholders, unless otherwise

required by law. Delaware law could require either our Class A common stock, Class B common stock or our

Class C common stock to vote separately as a single class in the following circumstances:

• If we were to seek to amend our Certificate of Incorporation to increase the authorized number of

shares of a class of stock, or to increase or decrease the par value of a class of stock; and

• If we were to seek to amend our Certificate of Incorporation in a manner that altered or changed the

powers, preferences or special rights of a class of stock in a manner that affected its holders adversely.

Liquidation. Upon our liquidation, dissolution or winding-up, the assets legally available for distribution to

our stockholders would be distributable ratably among the holders of our Class A, Class B and Class C common

stock after payment of liquidation preferences, if any, on any outstanding shares of our preferred stock.

Preemptive or Similar Rights. None of our Class A, Class B or Class C common stock is entitled to

preemptive rights, and neither is subject to redemption.

Conversion. Our Class A common stock is not convertible into any other shares of our capital stock. Each

share of our Class B common stock and Class C common stock is convertible at any time at the option of the

holder into one share of our Class A common stock. In addition, after the closing of the initial public offering,

upon sale or transfer of shares of either Class B common stock or Class C common stock, whether or not for

value, each such transferred share shall automatically convert into one share of Class A common stock, except

for certain transfers described in our amended and restated certificate of incorporation, including, without

limitation, transfers for tax and estate planning purposes, so long as the transferring holder continues to hold sole

voting and dispositive power with respect to the shares transferred. Our Class B common stock and Class C

common stock will convert automatically into Class A common stock on the date on which the number of

outstanding shares of Class B common stock and Class C common stock together represent less than 10% of the

aggregate combined voting power of our capital stock. Once transferred and converted into Class A common

stock, the Class B common stock and Class C common stock may not be reissued.

92