Western Union 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Executive Compensation PROXY STATEMENT

The Western Union Company – Proxy Statement | 64

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

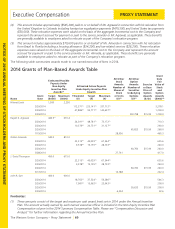

Footnotes:

(1) Grants prior to September 29, 2006 represent option awards granted to the named executive officer under the

2002 First Data Corporation Long Term Incentive Plan that were replaced with substitute Western Union options that

were adjusted to preserve the pre-conversion intrinsic value of the First Data Corporation options. A portion of the

substitute options vested through the normal passage of time. The remainder of these substitute options became

fully vested in September 2007 upon consummation of a change-in-control of First Data Corporation.

(2) The market value of shares or units of stock that have not vested reflects a stock price of $17.91, the closing stock

price on December 31, 2014.

(3) These options were awarded on February 20, 2014, and vest in 25% increments on each of the first through

fourth year anniversaries of the date of grant; provided that the executive is still employed by the Company on the

applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(4) These options were awarded on February 20, 2013, and vest in 25% increments on each of the first through

fourth year anniversaries of the date of grant; provided that the executive is still employed by the Company on the

applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(5) These options were awarded on February 23, 2012, and vest in 25% increments on each of the first through

fourth year anniversaries of the date of grant; provided that the executive is still employed by the Company on the

applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(6) These options vested on February 24, 2015.

(7) These options were awarded on September 15, 2011, and vest in 25% increments on each of the first through

fourth year anniversaries of the date of grant; provided that the executive is still employed by the Company on the

applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(8) These options were awarded on April 26, 2012, and vest in 25% increments on each of the first through fourth year

anniversaries of the date of grant; provided that the executive is still employed by the Company on the applicable

vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(9) Represents restricted stock units that were granted under the 2013 Annual Incentive Plan based on the achievement

of performance-based conditions during 2013. Thirty percent of these restricted stock units vested on February 20,

2015 and the remaining 70% of these restricted stock units are scheduled to vest on February 20, 2016, provided the

executive is still employed by the Company on the vesting date or as otherwise provided for pursuant to the Executive

Severance Policy.

(10) Represents performance-based restricted stock units that vested on February 23, 2015. The payout level for these

performance-based restricted stock units was determined based on the Company’s revenue, EBITDA and growth in

registered customers performance during the 2012-2013 performance period and remained subject to time-based

vesting requirements until February 23, 2015. Under the original terms of the award agreements, these awards were

also subject to payout modifiers based on TSR and stock price performance over the 2012-2014 performance period

if the payout level for the 2012-2013 performance goals was equal to or greater than 150% of target. Because the

payout levels for these awards was equal to 17% of target for the named executive officers other than Mr. Ersek, and

13% of target for Mr. Ersek, the TSR and stock price payout modifiers were not applied.

(11) Represents restricted stock units that were awarded on July 15, 2014, and vest in 25% increments on each of the

first through fourth year anniversaries of the date of grant; provided that the executive is still employed by the

Company on the applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(12) Represents restricted stock units that were awarded on March 28, 2014, and vest in 25% increments on each of

the first through fourth year anniversaries of the date of grant; provided that the executive is still employed by the

Company on the applicable vesting date or as otherwise provided for pursuant to the Executive Severance Policy.

(13) Represents restricted stock units that were awarded on February 7, 2013, and scheduled to vest on February 7,

2016; provided that the executive is still employed by the Company on the vesting date or as otherwise provided for

pursuant to the Executive Severance Policy.