Western Union 2014 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 FORM 10-K

84

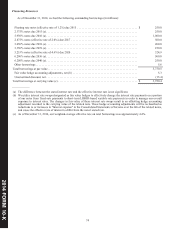

The carrying value of goodwill as of December 31, 2014 was $3,169.2 million which represented approximately 32% of our

consolidated assets. As of December 31, 2014, goodwill of $1,950.1 million and $996.0 million resides in our Consumer-to-

Consumer and Business Solutions reporting units, respectively. The remaining $223.1 million resides in multiple reporting units

which are included in either our Consumer-to-Business segment or Other. For the reporting units that comprise Consumer-to-

Consumer, Consumer-to-Business, and Other, the fair value of the businesses greatly exceed their carrying amounts.

For our Business Solutions reporting unit, which was acquired between 2009 and 2011, a decline in estimated fair value of

approximately 15% as of the testing date could occur before triggering an impairment of goodwill. The fair value calculation for

Business Solutions is highly sensitive to changes in projections for revenue growth rates and EBITDA margins. Our current

expectation is for Business Solutions to average high single digit annual revenue growth over the 10-year forecast period, with

average low double digit rates in the earlier years, driven by continued growth in global trade and increases in market share.

EBITDA margins are highly dependent on revenue growth, as over half of the Business Solutions cost base is fixed. Our ability

to achieve the projected revenue growth may be affected by, amongst other factors, (a) pricing and product competition from direct

competitors, banks and new market entrants; (b) our success and speed to market in developing new products; (c) the foreign

exchange impact from revenues generated in currencies other than the United States dollar; (d) increased regulatory compliance

requirements; (e) our ability to enter relationships with partners that can accelerate our time to market; (f) failure of long-term

import growth rates returning to historic levels; (g) our ability to continue to maintain our payment network and bank account

infrastructure; and (h) foreign currency volatility impacts on customer activity.

We believe that if Business Solutions is unable to achieve the projected financial performance, either in the near term or long

term, impairment is likely to result. Based on assumptions used within the Business Solutions reporting unit valuation, we believe

a decrease of 75 basis points in the ten-year compound annual growth rate of revenue (also reflecting the impact such a reduction

would have on EBITDA margins) would result in a reduction in the fair value of the Business Solutions reporting unit of

approximately $250 million. Such a reduction would result in the fair value approximating the carrying value of the reporting unit.

We did not record any goodwill impairments during the three years ended December 31, 2014.

Legal Contingencies

We are currently involved in various claims and legal proceedings. We regularly review the status of each significant matter

and assess our potential financial exposure. If the potential loss from any claim or legal proceeding is considered probable and the

amount can be reasonably estimated, we accrue a liability for the estimated loss. When a potential loss is considered probable and

the reasonable estimate is a range, we accrue on the low end of the range when no amount is a better estimate than any other

amount. There may be an exposure to loss in excess of any amounts accrued. Significant judgment is required in both the

determination of probability and the determination of whether an exposure is reasonably estimable including our evaluation of

outcomes when a range exists. Our judgments are subjective based on considerations such as the status of the legal or regulatory

proceedings, the merits of our defenses and consultations with in-house and outside legal counsel. Since the outcome of these

matters is uncertain, accruals are based only on the best information available at the time. As additional information becomes

available, we reassess the potential liability related to our pending claims and litigation and may revise our estimates which may

include information learned through the discovery process, rulings on motions to dispose, settlement discussions, and other rulings

by courts, arbitrators or others. Due to the inherent uncertainties of the legal and regulatory process in the multiple jurisdictions

in which we operate and the varied range of potential outcomes, our judgments may be materially different than the actual resolutions.