Western Union 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation Discussion and Analysis PROXY STATEMENT

39 | The Western Union Company – Proxy Statement

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

• Reviewsmarketdataandadvisesthecommittee

regarding the compensation of the Company’s

executive officers;

• Reviewsandadvisesthecommitteeregardingdirector

compensation; and

• PerformsanannualriskassessmentoftheCompany’s

compensation programs, as described in the “Executive

Compensation-Risk Management and Compensation”

section of this Proxy Statement.

The Compensation Consultant does not provide any other

services to the Company. The Compensation Committee

has assessed the independence of the Compensation

Consultant pursuant to the NYSE rules and the Company

concluded that the Compensation Consultant’s work for

the Compensation Committee did not raise any conflict

of interest.

During 2014, the Company also retained the services of

Towers Watson to assist the Company in evaluating the

Company’s annual and long-term incentive programs.

The Compensation Committee evaluated the findings of

Towers Watson in its review of the 2014 incentive program

design. The Compensation Committee has assessed the

independence of Towers Watson pursuant to the NYSE

rules and the Company concluded that Towers Watson’s

work did not raise any conflict of interest.

Setting 2014 Compensation

In late 2013, the Compensation Committee, working with

the Compensation Consultant and the Chief Executive

Officer, engaged in a detailed review of the Company’s

executive compensation programs to evaluate whether the

design and levels of each compensation element were:

• AppropriatetosupporttheCompany’sstrategic

performance objectives;

• Consistentwiththephilosophyandobjectivesdescribed

under “—Our Executive Compensation Philosophy and

Objectives” above; and

• Reasonablewhencomparedtomarketpaypractices

(see “—Market Comparison” below).

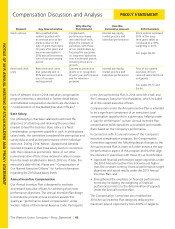

Specifically, the Compensation Committee approved

several modifications to the compensation program to

further align the executive compensation program with

evolving investor preferences, executive compensation

practices and market trends. These modifications included:

• ReplacingtheTSRmodifierincludedinour2013Long-

Term Incentive Plan design with a standalone TSR

PSU award;

• Increasingtheperformanceperiodforperformance-

based restricted stock units so that they are subject to a

three-year total performance period, versus the two-

year performance period used in prior years;

• Increasingthepercentageofourannualequity

grants that have vesting provisions that are strictly

performance-based and at-risk;

• Reducingthemaximumpayoutopportunityunderthe

Annual Incentive Plan from 200% of target to 150% of

target; and

• Establishingperformancegoalsthatexceed

performance during the prior three years.

In early 2014, Mr. Ersek presented to the Compensation

Committee his evaluation of each of the Executive

Vice Presidents and the level of his or her salary, annual

bonus targets under the Annual Incentive Plan, and

long-term incentive award targets under the Long-Term

Incentive Plan. Mr. Ersek based his assessments on each

executive’s performance and relative contributions to the

Company’s success, the performance of the executive’s

respective business unit or functional area, employee

retention considerations, compensation history and internal

equity. Mr. Ersek also reviewed with the committee tally

sheets that presented comprehensive historical and current

compensation data for each of the Company’s executive

officers. Please see “—Use of Tally Sheets” below for a

description of this tool. The Compensation Consultant

participated in the committee meetings to provide peer

group and market data regarding executive compensation.

Please see “—Market Comparison” for a discussion of the

use of peer group and market data.