Western Union 2014 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

104

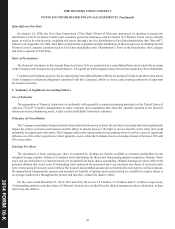

Foreign Currency Translation

The United States dollar is the functional currency for substantially all of the Company's businesses. Revenues and expenses

are translated at average exchange rates prevailing during the period. Foreign currency denominated assets and liabilities for those

businesses for which the local currency is the functional currency are translated into United States dollars based on exchange rates

at the end of the year. The effects of foreign exchange gains and losses arising from the translation of assets and liabilities of these

businesses are included as a component of "Accumulated other comprehensive loss" in the accompanying Consolidated Balance

Sheets. Foreign currency denominated monetary assets and liabilities of businesses for which the United States dollar is the

functional currency are remeasured based on exchange rates at the end of the period, and the resulting remeasurement gains and

losses are recognized in net income. Non-monetary assets and liabilities of these operations are remeasured at historical rates in

effect when the asset was recognized or the liability was incurred.

Derivatives

The Company uses derivatives to (a) minimize its exposures related to changes in foreign currency exchange rates and interest

rates and (b) facilitate cross-currency Business Solutions payments by writing derivatives to customers. The Company recognizes

all derivatives in the "Other assets" and "Other liabilities" captions in the accompanying Consolidated Balance Sheets at their fair

value. All cash flows associated with derivatives are included in cash flows from operating activities in the Consolidated Statements

of Cash Flows.

• Cash Flow hedges - Changes in the fair value of derivatives that are designated and qualify as cash flow hedges are

recorded in "Accumulated other comprehensive loss." Cash flow hedges consist of foreign currency hedging of forecasted

revenues, as well as hedges of the forecasted issuance of fixed rate debt. Derivative fair value changes that are captured

in "Accumulated other comprehensive loss" are reclassified to earnings in the same period or periods the hedged item

affects earnings, to the extent the instrument is effective in offsetting the change in cash flows attributable to the risk

being hedged. The portions of the change in fair value that are either considered ineffective or are excluded from the

measure of effectiveness are recognized immediately in "Derivative gains/(losses), net."

• Fair Value hedges - Changes in the fair value of derivatives that are designated as fair value hedges of fixed rate debt are

recorded in "Interest expense." The offsetting change in value of the related debt instrument attributable to changes in

the benchmark interest rate is also recorded in "Interest expense."

• Undesignated - Derivative contracts entered into to reduce the variability related to (a) money transfer settlement assets

and obligations, generally with maturities from a few days up to one month, and (b) certain foreign currency denominated

cash and other asset and liability positions, typically with maturities of less than one year at inception, are not designated

as hedges for accounting purposes and changes in their fair value are included in "Selling, general and administrative."

The Company is also exposed to risk from derivative contracts written to its customers arising from its cross-currency

Business Solutions payments operations. The duration of these derivative contracts at inception is generally less than one

year. The Company aggregates its Business Solutions payments foreign currency exposures arising from customer

contracts, including the derivative contracts described above, and hedges the resulting net currency risks by entering into

offsetting contracts with established financial institution counterparties (economic hedge contracts) as part of a broader

foreign currency portfolio, including significant spot exchanges of currency in addition to forwards and options. The

changes in fair value related to these contracts are recorded in "Foreign exchange revenues."

The fair value of the Company's derivatives is derived from standardized models that use market based inputs (e.g., forward

prices for foreign currency).