Western Union 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation Discussion and Analysis PROXY STATEMENT

The Western Union Company – Proxy Statement | 46

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

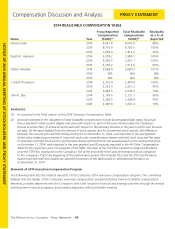

Element Key Characteristics

Why We Pay

This Element

How We

Determine Amount 2014 Decisions

Stock options Non-qualified stock

options granted with

an exercise price at fair

market value on the

date of grant that expire

10 years after grant and

become exercisable in

25% annual increments

over a four-year vesting

period.

Coupled with

performance-based

restricted stock units,

aligns the interests of

executives with those

of our stockholders by

focusing the executives

on long-term objectives

over a multi-year period,

including stock price

growth.

Internal pay equity,

market practice and

individual performance.

Stock options represent

20% of the long-

term grant value, as

compared to a 33%

weighting in 2013.

See pages 49-50.

Restricted stock

units

Restricted stock units

that generally vest in

25% annual increments

over a four-year

vesting period.

Granted as promotion

grants or in recognition

of prior year performance

and for retention

purposes.

Internal pay equity,

market practice and

individual performance.

Four of our named

executive officers

received restricted stock

unit grants.

See pages 49-51 and

54-56.

Each of Western Union’s 2014 executive compensation

program elements is described in further detail below

and individual compensation decisions are discussed in

“-Compensation of Our Named Executive Officers.”

Base Salary

Our philosophy is that base salaries should meet the

objectives of attracting and retaining the executives

needed to lead the business. Base salary is a fixed

compensation component payable in cash. In setting base

salary levels, the committee considered the peer group and

survey data as well as the performance of the individual

executive. During 2014, Messrs. Agrawal and Almeida

received increases in their base salary levels in connection

with their respective promotions. None of our other

named executive officers have received a salary increase

from the levels established in March 2012 (or, if later, the

executive’s date of hire). Please see “-Compensation of

Our Named Executive Officers” for further information

regarding the 2014 base salary levels.

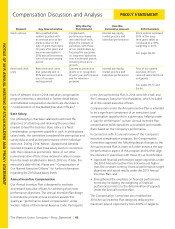

Annual Incentive Compensation

Our Annual Incentive Plan is designed to motivate

and reward executive officers for achieving short-term

performance objectives. The Annual Incentive Plan design

is intended to provide annual incentive awards that

qualify as “performance-based compensation” under

Section 162(m) of the Internal Revenue Code. Participants

in the Annual Incentive Plan in 2014 were Mr. Ersek and

the Company’s Executive Vice Presidents, which included

all of the named executive officers.

Compensation under the Annual Incentive Plan is intended

to be a significant component of an executive’s total

compensation opportunity in a given year, helping create

a “pay for performance” culture. Annual Incentive Plan

compensation holds executives accountable and rewards

them based on the Company’s performance.

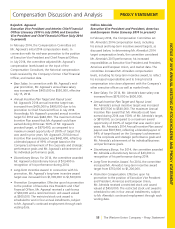

In connection with its annual review of the Company’s

executive compensation program, the Compensation

Committee approved the following design changes to the

Annual Incentive Plan in order to further enhance the pay-

for-performance aspect of this program and further align

the interests of executives with those of our stockholders:

• Approvedfinancialperformancetargetobjectivesunder

the 2014 Annual Incentive Plan that were set higher

than the constant currency financial performance target

objectives and actual results under the 2013 Annual

Incentive Plan; and

• Strengthenedtheemphasisonfinancialperformance

metrics by increasing the weighting of financial

performance metrics in the determination of payouts

under the Annual Incentive Plan.

The Compensation Committee also modified the

2014 Annual Incentive Plan design by reducing the

maximum payout opportunity from 200% of target to