Western Union 2014 Annual Report Download - page 246

Download and view the complete annual report

Please find page 246 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

108

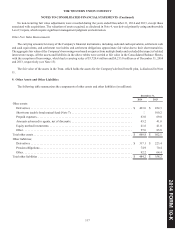

5. Commitments and Contingencies

Letters of Credit and Bank Guarantees

The Company had approximately $210 million in outstanding letters of credit and bank guarantees as of December 31, 2014.

The letters of credit and bank guarantees are primarily held in connection with lease arrangements, certain agent agreements, and

in relation to an uncertain tax position. The letters of credit and bank guarantees have expiration dates through 2018, with the

majority having a one-year renewal option. The Company expects to renew the letters of credit and bank guarantees prior to

expiration in most circumstances. The bank guarantees related to the uncertain tax position were extinguished in January 2015

after resolution of the related matter.

Litigation and Related Contingencies

The Company is subject to certain claims and litigation that could result in losses, including damages, fines and/or civil

penalties, which could be significant, or criminal charges. Substantially all of the Company's contingencies are subject to significant

uncertainties and, therefore, determining the likelihood of a loss and/or the measurement of any loss can be complex. The Company

does not currently believe that any of these matters, individually or in the aggregate, will have a material adverse effect on its

financial position. However, litigation is inherently unpredictable and the Company could incur judgments, enter into settlements

or revise its expectations regarding the outcome of certain matters, and such developments could have a material adverse effect

on its financial position, results of operations or cash flows in the periods in which amounts are accrued or paid. The principal

pending matters the Company is a party to are discussed below.

State of Arizona Settlement Agreement

On February 11, 2010, Western Union Financial Services, Inc. ("WUFSI"), a subsidiary of the Company, signed a settlement

agreement ("Southwest Border Agreement"), which resolved all outstanding legal issues and claims with the State of Arizona (the

"State") and required the Company to fund a multi-state not-for-profit organization promoting safety and security along the United

States and Mexico border, in which California, Texas and New Mexico are participating with Arizona. As part of the Southwest

Border Agreement, the Company has made and expects to make certain investments in its compliance programs along the United

States and Mexico border and a monitor (the "Monitor") has been engaged for those programs. The Company has incurred, and

expects to continue to incur, significant costs in connection with the Southwest Border Agreement. The Monitor has made a number

of recommendations related to the Company's compliance programs, which the Company is implementing, including programs

related to our Business Solutions segment.

On January 31, 2014, the Southwest Border Agreement was amended to extend its term until December 31, 2017 (the

"Amendment"). The Amendment imposes additional obligations on the Company and WUFSI in connection with WUFSI’s anti-

money laundering ("AML") compliance programs and cooperation with law enforcement. In particular, the Amendment requires

WUFSI to continue implementing the primary and secondary recommendations made by the Monitor appointed pursuant to the

Southwest Border Agreement related to WUFSI’s AML compliance program, and includes, among other things, timeframes for

implementing such primary and secondary recommendations. Under the Amendment, the Monitor could make additional primary

recommendations until January 1, 2015 and may make additional secondary recommendations until January 31, 2017. After these

dates, the Monitor may only make additional primary or secondary recommendations, as applicable, that meet certain requirements

as set forth in the Amendment. Primary recommendations may also be re-classified as secondary recommendations.