Western Union 2014 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

121

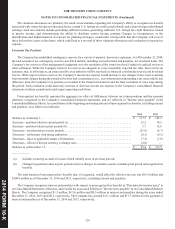

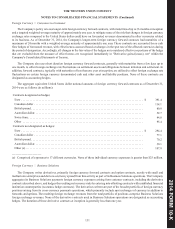

The unrecognized tax benefits accrual as of December 31, 2014 consists of federal, state and foreign tax matters. It is reasonably

possible that the Company's total unrecognized tax benefits will decrease by approximately $26 million during the next 12 months

in connection with various matters which may be resolved.

The Company and its subsidiaries file tax returns for the United States, for multiple states and localities, and for various non-

United States jurisdictions, and the Company has identified the United States as its major tax jurisdiction, as the income tax imposed

by any one foreign country is not material to the Company. The United States federal income tax returns of First Data, which

include the Company, are eligible to be examined for 2005 and 2006. The Company's United States federal income tax returns

since the Spin-off are also eligible to be examined.

The United States Internal Revenue Service ("IRS") completed its examination of the United States federal consolidated

income tax returns of First Data for 2003 and 2004, which included the Company, and issued a Notice of Deficiency in December

2008. In December 2011, the Company reached an agreement with the IRS resolving substantially all of the issues related to the

Company's restructuring of its international operations in 2003 ("IRS Agreement"). As a result of the IRS Agreement, the Company

expects to make cash payments of approximately $190 million, plus additional accrued interest, of which $94.1 million has been

paid as of December 31, 2014. A substantial majority of these payments were made in the year ended December 31, 2012. The

Company expects to pay the remaining amount in 2015 and beyond. The IRS completed its examination of the United States

federal consolidated income tax returns of First Data, which include the Company's 2005 and pre-Spin-off 2006 taxable periods

and issued its report on October 31, 2012 ("FDC 30-Day Letter"). Furthermore, the IRS completed its examination of the Company's

United States federal consolidated income tax returns for the 2006 post-Spin-off period through 2009 and issued its report also on

October 31, 2012 ("WU 30-Day Letter"). Both the FDC 30-Day Letter and the WU 30-Day Letter propose tax adjustments affecting

the Company, some of which are agreed and some of which are unagreed. Both First Data and the Company filed their respective

protests with the IRS Appeals Division on November 28, 2012 related to the unagreed proposed adjustments. Discussions with

the IRS concerning these adjustments are ongoing. The Company believes its reserves are adequate with respect to both the agreed

and unagreed adjustments.

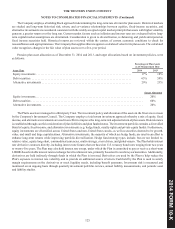

As of December 31, 2014, no provision has been made for United States federal and state income taxes on certain of the

Company's outside tax basis differences, which primarily relate to accumulated foreign earnings of approximately $5.6 billion,

which have been reinvested and are expected to continue to be reinvested outside the United States indefinitely. Over the last

several years, such earnings have been used to pay for the Company's international acquisitions and operations and provide initial

Company funding of global principal payouts for Consumer-to-Consumer and Business Solutions transactions. Upon distribution

of those earnings to the United States in the form of actual or constructive dividends, the Company would be subject to United

States income taxes (subject to an adjustment for foreign tax credits), state income taxes and possible withholding taxes payable

to various foreign countries. Such taxes could be significant. Determination of this amount of unrecognized United States deferred

tax liability is not practicable because of the complexities associated with its hypothetical calculation.

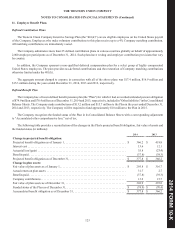

Tax Allocation Agreement with First Data

The Company and First Data each are liable for taxes imposed on their respective businesses both prior to and after the Spin-

off. If such taxes have not been appropriately apportioned between First Data and the Company, subsequent adjustments may occur

that may impact the Company's financial condition or results of operations.