Western Union 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33 | The Western Union Company – Proxy Statement

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Compensation Discussion and Analysis PROXY STATEMENT

equity awards under the Long-Term Incentive Plan

consisted of 80% performance-based restricted stock

units (60% Financial PSUs, incorporating both revenue

and operating income growth and 20% TSR PSUs) and

20% stock options, as compared to 67% performance-

based restricted stock units and 33% stock options

in 2013.

• Established Goals Exceeding Performance During

Prior Three Years: The financial performance target

objectives for the 2014 compensation program were

set at constant currency growth rates that are higher

than the Company’s average annual constant currency

results achieved over 2011 through 2013. The 2014

Annual Incentive Plan financial performance target

objectives were also set higher than the constant

currency financial performance target objectives and

actual results under the 2013 Annual Incentive Plan. For

the 2014 Annual Incentive Plan, performance at 184%

of the target revenue growth rate and at 200% of the

target operating income growth rate is required for a

maximum payout equal to 150% of the target award.

Further, the Company’s relative TSR performance

rank versus the S&P 500 Index over the 2014-2016

performance period that is required to earn a target

payout under the 2014 TSR PSUs is higher than the

Company’s annual relative TSR performance versus the

S&P 500 Index in each of 2011, 2012, and 2013.

• Reduced Maximum Payout Under Annual

Incentive Plan: The Compensation Committee reduced

the maximum payout opportunity under the Annual

Incentive Plan to 150% of target, as compared to the

200% of target maximum payout opportunity that was

used in prior years.

• Reduced Severance Benefits Under Executive

Severance Policy: During 2014, the Compensation

Committee amended the Executive Severance Policy

to reduce the severance multiple for determining

severance benefits prior to a change-in-control from

2 to 1.5 for participants other than the Company’s

Chief Executive Officer.

Chief Executive Officer Compensation

For 2014 performance, Mr. Ersek received a cash payout

under the 2014 Annual Incentive Plan of $1,314,800,

reflecting a blended payout of 88% of target based

on the Company’s achievement of corporate and

strategic performance goals, as compared to an 84%

of target payout for 2013 performance and no payout

for 2012 performance. The Compensation Committee

based Mr. Ersek’s award opportunity under the Annual

Incentive Plan on the achievement of corporate and

strategic performance goals and did not include individual

performance goals. As noted above, the 2014 Annual

Incentive Plan financial performance target objectives

were set higher than the constant currency financial

performance target objectives and actual results under the

2013 Annual Incentive Plan. Also for 2014, the committee

awarded Mr. Ersekadiscretionarybonusof$115,000in

recognition of his leadership in enhancing the Company’s

global compliance programs.

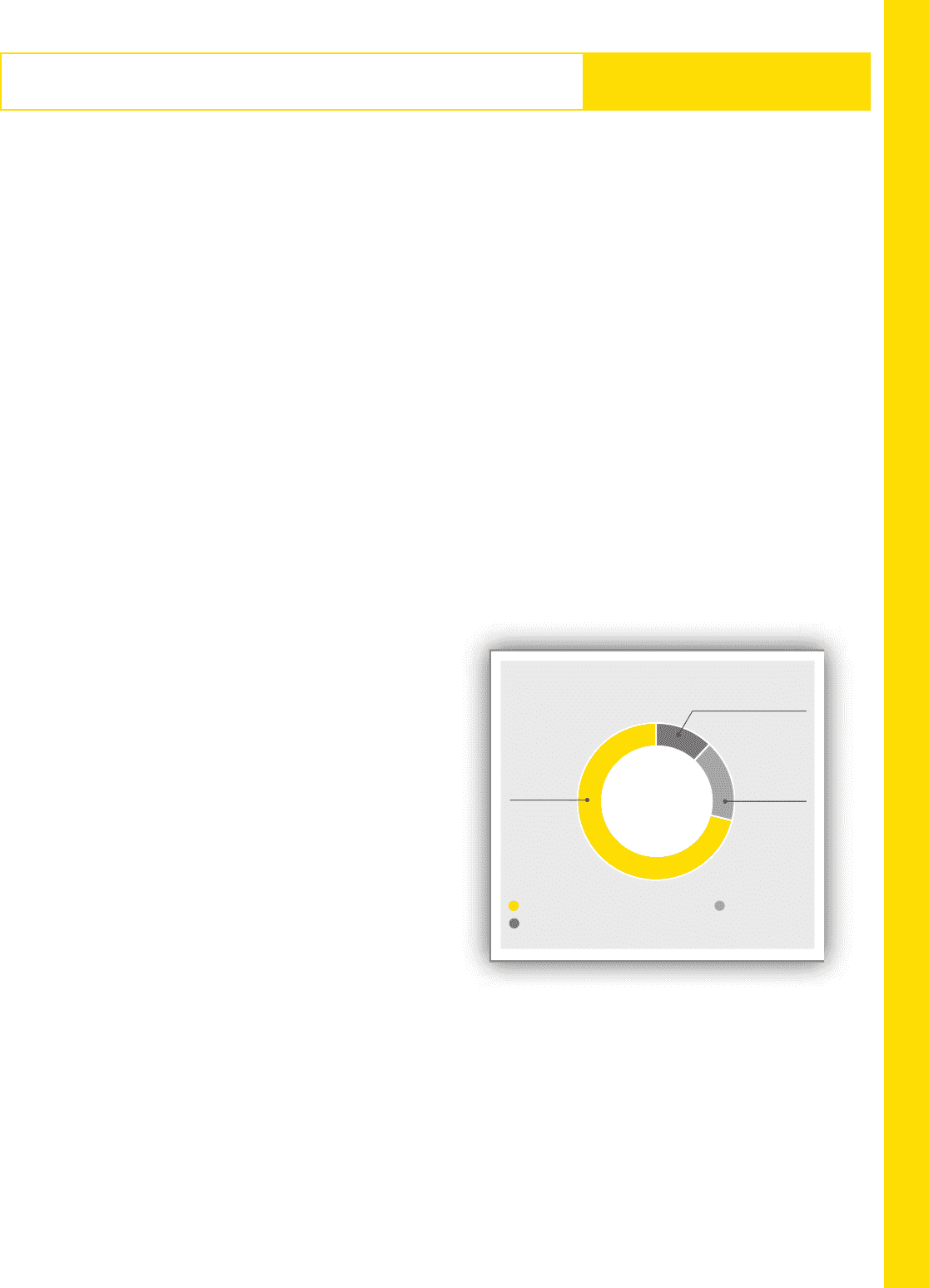

The following chart demonstrates that variable,

performance-based pay elements comprised approximately

88% of the targeted 2014 annual compensation for

Mr. Ersek (consisting of target payout opportunity

under the Annual Incentive Plan and stock option and

performance-based restricted stock unit components

under the Long-Term Incentive Plan). Pay is based on the

annual base salary and target incentive opportunities

applicable to Mr. Ersek as of December 31, 2014.

17%

12%

71%

Annual Incentive

Base Salary

Long-Term Equity Compensation

CHIEF EXECUTIVE OFFICER

2014 TOTAL DIRECT COMPENSATION

Since a significant portion of Mr. Ersek’s compensation is

both performance-based and “at-risk,” we are providing

the following supplemental graph to demonstrate

the difference between the compensation granted to

Mr. Ersek as required to be reported by the SEC rules

in the 2014 Summary Compensation Table, and the

compensation “realizable” by him for 2012 to 2014.