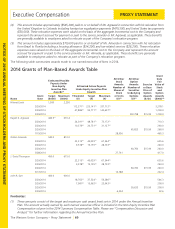

Western Union 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 | The Western Union Company – Proxy Statement

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Compensation Discussion and Analysis PROXY STATEMENT

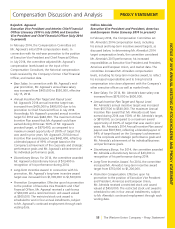

award target. The terms of the executive’s employment are

based thereafter on sustained good performance rather

than contractual terms, and the Company’s policies, such

as the Executive Severance Policy, will apply as warranted.

Under certain circumstances, the Compensation

Committee recognizes that special arrangements with

respect to an executive’s employment may be necessary

or desirable. For example, Mr. Ersek, the Company, and

a subsidiary of the Company entered into agreements

in November 2009 relating to his 2009 promotion to

Chief Operating Officer, which were amended effective

September 2010 to reflect his 2010 promotion to

President and Chief Executive Officer. Employment

contracts are a competitive market practice in Austria

where Mr. Ersek resided at the time he assumed his

position as Chief Operating Officer and the Compensation

Committee believes the terms of his agreements are

consistent with those for similarly situated executives in

Austria. In addition, the Company entered into a letter

agreement with Mr. Agrawal in January 2012 describing

the terms and conditions applicable to Mr. Agrawal’s

2012-2013 expatriate assignment. Please see the

“Executive Compensation—Narrative to Summary

Compensation Table and Grants of Plan-Based Awards

Table—Employment Arrangements” section of this Proxy

Statement for a description of the material terms of

Mr. Ersek’s employment agreement and Mr. Agrawal’s

expatriate agreement.

Stock Ownership Guidelines

To align our executives’ interests with those of our

stockholders and to assure that our executives own

meaningful levels of Western Union stock throughout

their tenures with the Company, the Compensation

Committee established stock ownership guidelines that

require each of the named executive officers to own

Company Common Stock worth a multiple of base salary.

Under the stock ownership guidelines, the executives must

retain, until the required ownership guideline levels have

been achieved and thereafter if required to maintain the

required ownership levels, at least 50% of after-tax shares

resulting from the vesting of restricted stock and restricted

stock units and at least 50% of the shares acquired upon

exercise of stock options after the payment of the exercise

price, broker fees, and related tax withholding obligations.

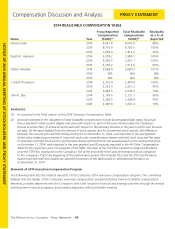

The chart below shows the salary multiple guidelines and

the equity holdings that count towards the requirement

as of March 19, 2015. Each named executive officer has

met, or is progressing towards meeting, his respective

ownership guideline.

Executive Guideline Status

Hikmet Ersek 5x salary Meets guideline

Rajesh K. Agrawal 2x salary Meets guideline

Odilon Almeida 2x salary Must hold 50% of

after-tax shares until

guideline is met

J. David Thompson 2x salary Meets guideline

John R. Dye 2x salary Must hold 50% of

after-tax shares until

guideline is met

What Counts Toward the

Guideline

What Does Not Count

Toward the Guideline

• WesternUnionsecurities

owned personally

• Unexercisedstock

options

• SharesheldinanyWestern

Union benefit plan

• Performance-based

restricted stock units

• After-taxvalueofrestricted

stock and restricted stock

units

Prohibition Against Pledging and Hedging of the

Company’s Securities

The Company’s insider trading policy prohibits the

Company’s executive officers and directors from pledging

the Company’s securities or engaging in hedging or short-

term speculative trading of the Company’s securities,

including, without limitation, short sales or put or call

options involving the Company’s securities.

Clawback Policy

The Board of Directors adopted a clawback policy in

2009. Under the policy, the Company may, in the Board’s

discretion and subject to applicable law, recover incentive

compensation paid to an executive officer of the Company

(defined as an individual subject to Section 16 of the

Exchange Act, at the time the incentive compensation

was received by or paid to the officer) if the compensation

resulted from any financial result or performance