Western Union 2014 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

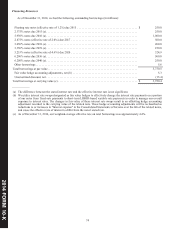

2014 FORM 10-K

75

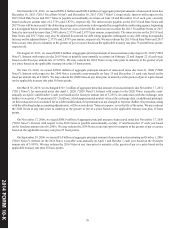

Commercial Paper Program

Pursuant to our commercial paper program, we may issue unsecured commercial paper notes in an amount not to exceed $1.5

billion outstanding at any time, reduced to the extent of borrowings outstanding on our Revolving Credit Facility in excess of $150

million. Our commercial paper borrowings may have maturities of up to 397 days from date of issuance. Interest rates for borrowings

are based on market rates at the time of issuance. As of December 31, 2014 and 2013, we had no commercial paper borrowings

outstanding. During the year ended December 31, 2014, the average commercial paper balance outstanding was $13.3 million,

and the maximum balance outstanding was $200.0 million. We had a maximum balance outstanding of $50 million for one day

during the year ended December 31, 2013. During the year ended December 31, 2012, the average commercial paper balance

outstanding was $161.3 million, and the maximum balance outstanding was $422.8 million. Proceeds from our commercial paper

borrowings were used for general corporate purposes.

Revolving Credit Facility

On September 23, 2011, we entered into a credit agreement which expires January 2017 providing for unsecured financing

facilities in an aggregate amount of $1.65 billion, including a $250.0 million letter of credit sub-facility and a $150.0 million swing

line sub-facility.

Interest due under the Revolving Credit Facility is fixed for the term of each borrowing and is payable according to the terms

of that borrowing. Generally, interest is calculated using a selected LIBOR rate plus an interest rate margin of 110 basis points. A

facility fee of 15 basis points is also payable quarterly on the total facility, regardless of usage. Both the interest rate margin and

facility fee percentage are based on certain of our credit ratings.

The purpose of our Revolving Credit Facility, which is diversified through a group of 17 participating institutions, is to provide

general liquidity and to support our commercial paper program, which we believe enhances our short-term credit rating. The largest

commitment from any single financial institution within the total committed balance of $1.65 billion is approximately 12%. As

of and during the years ended December 31, 2014 and 2013, we had no outstanding borrowings under our Revolving Credit Facility.

If the amount available to borrow under the Revolving Credit Facility decreased, or if the Revolving Credit Facility were eliminated,

the cost and availability of borrowing under the commercial paper program may be impacted.

Notes

On November 22, 2013, we issued $250.0 million of aggregate principal amount of unsecured notes due May 22, 2019 ("2019

Notes"). Interest with respect to the 2019 Notes is payable semi-annually in arrears on May 22 and November 22 of each year,

beginning on May 22, 2014, based on the fixed per annum rate of 3.350%. The interest rate payable on the 2019 Notes will be

increased if the debt rating assigned to the note is downgraded by an applicable credit rating agency, beginning at a downgrade

below investment grade. However, in no event will the interest rate on the 2019 Notes be increased by more than 2.00% above

3.350% per annum. The interest rate payable on the 2019 Notes may also be adjusted downward for debt rating upgrades subsequent

to any debt rating downgrades but may not be adjusted below 3.350% per annum. We may redeem the 2019 Notes at any time

prior to maturity at the greater of par or a price based on the applicable treasury rate plus 30 basis points.

On August 22, 2013, we issued $250.0 million of aggregate principal amount of unsecured floating rate notes due August 21,

2015 ("2015 Floating Rate Notes"). Interest with respect to the 2015 Floating Rate Notes is payable quarterly in arrears on each

February 21, May 21, August 21, and November 21, beginning November 21, 2013, at a per annum rate equal to the three-month

LIBOR plus 1.0% (reset quarterly).