Western Union 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation Discussion and Analysis PROXY STATEMENT

The Western Union Company – Proxy Statement | 50

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

• Increase cross-functional executive focus in the

coming years on key performance metrics through

Financial PSUs;

• Amplify executive focus on stockholder returns through

TSR PSUs; and

• Retain the services of executives through multi-year

vesting provisions.

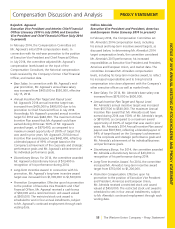

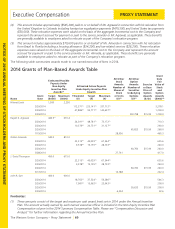

In February 2014, the Compensation Committee

granted the Chief Executive Officer and the Executive

Vice Presidents long-term incentive awards under the

Long-Term Incentive Plan. The awards consisted of 80%

performance-based restricted stock units (60% Financial

PSUs, incorporating both revenue and operating income

growth, and 20% TSR PSUs) and 20% stock options. The

committee believed that the mix of stock options, Financial

PSUs and TSR PSUs was appropriate because these forms

of awards combined represented a balanced reflection

of stockholder returns and financial performance. The

stock options vest in 25% annual increments over four

years and have a 10-year term. The performance-based

restricted stock unit awards are described in greater detail

below. In addition, as discussed in “—Compensation of

Our Named Executive Officers” below, Messrs. Agrawal,

Almeida, Thompson and Dye each received time-based

restricted stock unit grants in 2014 in connection with

promotions or in recognition of 2013 performance and for

retention purposes.

Financial PSUs. The 2014 Financial PSU awards will vest

if and only to the extent that specific performance goals

for revenues and operating income are met during the

performance period. To motivate constant improvement

over prior year results, the performance objectives under

the 2014 Financial PSUs design are based on targeted

constant currency compound annual growth rates

(“CAGR”) for revenue and operating income. At the

beginning of the performance period, the committee

established revenue and operating income CAGR goals

for each year of the performance period, with each year

weighted equally in the determination of the award

payout. Under the terms of the awards, as much as 150%

of the targeted Financial PSUs may be earned based on

the Company’s performance with respect to the revenue

and operating income performance objectives. In order to

receive a threshold payout under the award, the three-

year CAGR for both revenue and operating income must

be positive.

The performance objectives for payment of the 2014

Financial PSU awards and their respective weightings are:

• TargetedCAGRforrevenueandoperatingincome(each

weighted 50%), comparing 2014 actual performance

against 2013 actual performance (weighting 33-1/3%);

• TargetedCAGRforrevenueandoperatingincome(each

weighted 50%), comparing 2015 actual performance

against 2014 actual performance (weighting 33-1/3%);

and

• TargetedCAGRforrevenueandoperatingincome(each

weighted 50%), comparing 2016 actual performance

against 2015 actual performance (weighting 33-1/3%).

Similar to the Annual Incentive Plan, when the financial

performance objectives were established, the committee

determined that the effect of currency fluctuations on

revenue and operating income over the course of the

year should be excluded from the award calculation, as

it believed compensation should not be based on factors

outside of the control of our executives.

In order to achieve target performance for the first year of

the three-year performance period, the Company had to

achieve constant currency revenue and operating income

growth of 3.8% and 5.5%, respectively, as compared to

2013 actual performance. Based on 2014 performance,

the Company achieved revenues and operating income of

approximately $5.76 billion and $1.18 billion, respectively,

resulting in a blended achievement with respect to the

first year of the three-year performance period of 107%

of target. This portion of the award remains subject to

the requirement for a three-year positive CAGR in both

revenue and operating income as well as the participant’s

continued service through February 20, 2017.