Western Union 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 | The Western Union Company – Proxy Statement

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Compensation Discussion and Analysis PROXY STATEMENT

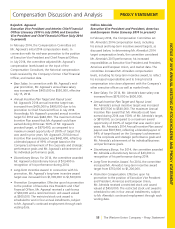

Incentive Plan design included a payout modifier with

respect to the portion of the bonus opportunity allocated

to individual and business unit performance objectives.

Under the plan design, the Compensation Committee

retained the discretion to modify the deemed overall

attainment of the individual and business unit performance

objectives based on a qualitative assessment performed by

the Compliance Committee of the Board of employee and

Company execution on compliance initiatives. For 2014,

the Compensation Committee, based on the Compliance

Committee’s qualitative assessment, utilized the payout

modifier to increase the 2014 Annual Incentive Plan

payouts by approximately 6% to 7% of the target award

opportunity for each named executive officer other than

the Chief Executive Officer in recognition of enhancements

made to the Company’s global compliance programs.

The committee believes the performance objectives

established for each of the named executive officers

are indicators of the executive’s success in fulfilling the

executive’s responsibilities to the Company and support

the Company’s strategic operating plan. The committee

also believes that including compliance as both a

performance objective and a payout modifier reinforces

compliance as a priority throughout the organization. The

performance levels of the individual and business unit

objectives were designed to be achievable, but required

strong and consistent performance by the executive. Please

see “-Compensation of Our Named Executive Officers” for

a discussion of the annual incentive payouts received by

each named executive officer.

Long-Term Incentive Compensation

The Long-Term Incentive Plan allows the Compensation

Committee to award various forms of long-term incentive

grants, including stock options, restricted stock units,

performance-based equity and performance-based cash

awards. The Compensation Committee has sole discretion

in selecting participants for long-term incentive grants

and the Compensation Committee approves all equity

grants made to our senior executives, with the equity

grants made to the Chief Executive Officer ratified by the

independent directors of the Board. When making regular

annual equity grants, the Compensation Committee’s

practice is to approve them during the first quarter of each

year as part of the annual compensation review. Among

other factors, the Compensation Committee considers

dilution of the Company’s outstanding shares when

making such grants.

2014 Enhancements to Long-Term Incentive Awards. As part

of its ongoing review of the executive compensation program

during 2014, and based on input from the Compensation

Consultant, the Compensation Committee approved certain

changes to the Company’s long-term incentive program in

order to further enhance the Company’s pay-for-performance

philosophy and further align the interests of executives with

those of our stockholders. Accordingly, in February 2014,

the Compensation Committee approved the following

modifications to the Company’s long-term incentive program:

• Created Standalone TSR PSUs: We replaced the TSR

modifier from our 2013 Long-Term Incentive Plan design

with a standalone TSR PSU award in order to enhance

focus on stockholder returns.

• Increased Performance Period for Performance-

Based Restricted Stock Units: We increased the

performance period of our performance-based

restricted stock units from two years to three years.

• Diversified Long-Term Incentive Plan Mix and

Increased Weighting of At-Risk Awards: We

increased the percentage of our annual equity grants

that have vesting provisions that are strictly performance-

based and at-risk.

• Established Goals Exceeding Performance During

Prior Three Years: The financial performance target

objectives for the 2014 Financial PSUs were set at

constant currency growth rates that are higher than

the Company’s average annual constant currency

results achieved over 2011 through 2013. Further, the

Company’s relative TSR performance rank versus the

S&P 500 Index over a 2014-2016 performance period

that is required to earn a target payout under the terms

of the 2014 TSR PSUs is higher than the Company’s

annual relative TSR performance versus the S&P 500

Index in each of 2011, 2012, and 2013.

2014 Annual Long-Term Incentive Awards. The

Compensation Committee’s objectives for the 2014

long-term incentive awards were to:

• Align the interests of our executives with the interests

of our stockholders by focusing on objectives that

result in stock price appreciation through the use of

stock options;