WeightWatchers 2013 Annual Report Download - page 96

Download and view the complete annual report

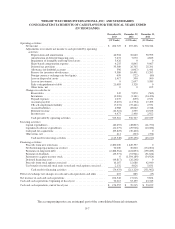

Please find page 96 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Impairment of Long Lived Assets:

The Company reviews long-lived assets, including amortizable intangible assets, for impairment whenever

events or changes in business circumstances indicate that the carrying amount of the assets may not be fully

recoverable.

In fiscal 2013, the Company commenced the shutdown of its China operations and, as a result, recorded an

impairment charge of $1,607 related to property, plant and equipment ($372) and amortizable intangible assets

($1,235). The Company also recorded an impairment charge of $2,653 in fiscal 2013 related to internal-use

computer software that was not expected to provide substantive service potential.

Franchise Rights Acquired, Goodwill and Other Intangible Assets:

Finite-lived intangible assets are amortized using the straight-line method over their estimated useful lives

of 3 to 20 years. The Company reviews goodwill and other indefinite-lived intangible assets, including franchise

rights acquired, for potential impairment on at least an annual basis or more often if events so require. The

Company performed fair value impairment testing as of the end of fiscal 2013 and fiscal 2012 on its goodwill

and other indefinite-lived intangible assets.

In performing the impairment analysis for goodwill, the fair value for the Company’s reporting units is

estimated using a discounted cash flow approach. This approach involves projecting future cash flows

attributable to the reporting unit and discounting those estimated cash flows using an appropriate discount rate.

The estimated fair value is then compared to the carrying value of the reporting unit. The Company has

determined the appropriate reporting unit for purposes of assessing annual impairment to be the country for all

reporting units aside from WW.com, for which the reporting unit has been aggregated into one unit. The values

of goodwill for the WWI reporting units in the United States, Canada and other countries at December 28, 2013

were $32,668, $5,124 and $3,677, respectively, totaling $41,469. The value of goodwill for the WW.com

reporting unit at December 28, 2013 was $37,825.

In performing the impairment analysis for franchise rights acquired, the fair value for the Company’s

franchise rights acquired is estimated using a discounted cash flow approach referred to as the hypothetical start-

up approach. The estimated fair value is then compared to the carrying value of the unit of accounting for those

franchise rights. The Company has determined the appropriate unit of account for purposes of assessing annual

impairment to be the country in which the acquisitions have occurred. The values of these franchise rights in the

United States, Canada, United Kingdom, Australia/New Zealand and other countries at December 28, 2013 were

$697,334, $110,346, $14,401, $13,740 and $1,014, respectively, totaling $836,835.

When determining fair value, the Company utilizes various assumptions, including projections of future

cash flows, growth rates and discount rates. A change in these underlying assumptions will cause a change in the

results of the tests and, as such, could cause fair value to be less than the carrying amounts. In the event such a

decrease occurred, the Company would be required to record a corresponding charge, which would impact

earnings. The Company would also be required to reduce the carrying amounts of the related assets on its balance

sheet. The Company continues to evaluate these estimates and assumptions and believes that these assumptions

are appropriate.

In performing the impairment analysis for the fiscal year ended December 28, 2013, the Company

determined that, based on the fair values calculated, the carrying amounts of the franchise rights acquired related

to its Mexico and Hong Kong operations exceeded their respective fair values as of the end of fiscal 2013 and

F-10