WeightWatchers 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2012

Net cash used for investing activities totaled $109.5 million in fiscal 2012, an increase of $64.3 million as

compared to fiscal 2011. This increase was primarily attributable to additional capital expenditures in connection

with our retail initiative and capitalized software expenditures to support global systems initiatives, as well as the

$30.4 million paid in connection with our acquisitions of substantially all of the assets of our following

franchisees: Slengora Limited, Weight Watchers of the Adirondacks, Inc. and Weight Watchers of the Mid-

South, Inc.

Financing Activities

Fiscal 2013

Net cash used for financing activities totaled $74.4 million in fiscal 2013 and included $44.8 million of

deferred financing fees in connection with our April 2013 debt refinancing. Additionally, term loan payments

under our then existing credit facility of $2.41 billion were offset by new borrowings of $2.40 billion in

connection with our April 2013 debt refinancing. In addition, we paid $29.6 million of dividends to our

shareholders which offset $18.3 million in proceeds from stock options exercised and the tax benefit thereon in

fiscal 2013.

Fiscal 2012

Net cash used for financing activities totaled $211.1 million in fiscal 2012 and included proceeds from new

term loans under our then existing credit facilities of $1.45 billion and additional revolver borrowings of $30.0

million which were used to finance stock repurchases of $1.5 billion and deferred financing costs of $26.2

million in connection with the Tender Offer and related Artal Holdings share repurchase. See “—Stock

Transactions” for a description of the Tender Offer and the related Artal Holdings share repurchase. In addition,

we paid $52.0 million of dividends to our shareholders and received $12.7 million in proceeds from stock options

exercised in fiscal 2012.

Fiscal 2011

Net cash used for financing activities totaled $352.0 million in fiscal 2011 and consisted primarily of

payments on our then existing revolving credit facility of $174.0 million and long-term debt repayments of

$139.3 million, as well as stock repurchases of $34.9 million and dividend payments to our shareholders of $51.6

million. Offsetting these payments were proceeds from stock options exercised of $42.0 million in fiscal 2011.

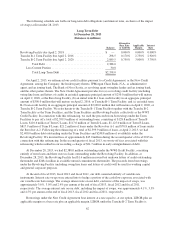

Long-Term Debt

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate.

61