WeightWatchers 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

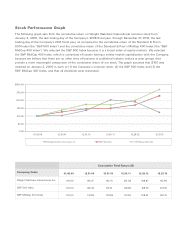

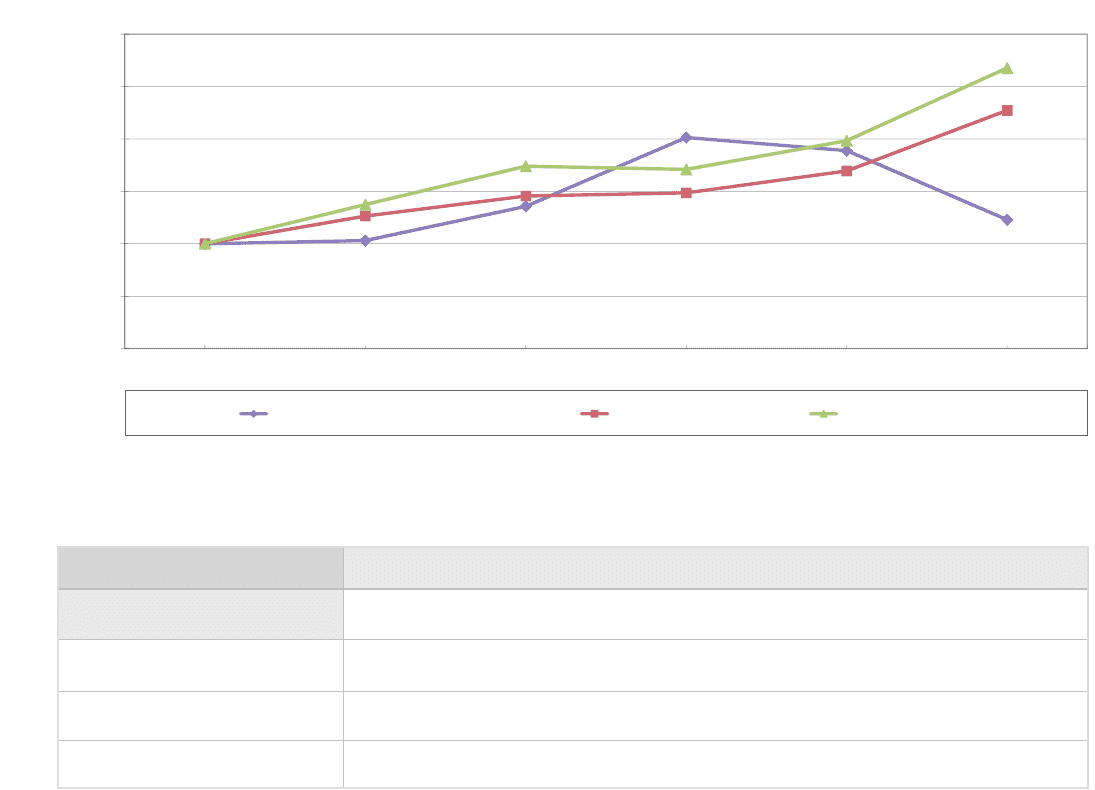

The following graph sets forth the cumulative return on Weight Watchers International common stock from

January 2, 2009, the last trading day of the Company’s 2008 fiscal year, through December 27, 2013, the last

trading day of the Company’s 2013 fiscal year, as compared to the cumulative return of the Standard & Poor’s

500 Index (the “S&P 500 Index”) and the cumulative return of the Standard & Poor’s MidCap 400 Index (the “S&P

MidCap 400 Index”). We selected the S&P 500 Index because it is a broad index of equity markets. We selected

the S&P MidCap 400 Index, which is comprised of issuers having a similar market capitalization with the Company,

because we believe that there are no other lines of business or published industry indices or peer groups that

provide a more meaningful comparison of the cumulative return of our stock. The graph assumes that $100 was

invested on January 2, 2009 in each of (1) the Company’s common stock, (2) the S&P 500 Index and (3) the

S&P MidCap 400 Index, and that all dividends were reinvested.

Stock Performance Graph

Company/Index

Weight Watchers International, Inc.

S&P 500 Index

S&P MidCap 400 Index

Cumulative Total Return ($)

01.02.09 12.31.09 12.31.10 12.30.11 12.28.12 12.27.13

100.00 103.07 135.70 201.38 188.87 122.96

100.00 126.46 145.51 148.58 169.49 227.30

100.00

137.38 173.98 170.94 198.32 267.70

0.00

50.00

100.00

150.00

200.00

250.00

300.00

$300.00

250.00

200.00

150.00

100.00

50.00

0.00

01.02.09 12.31.09 12.31.10 12.30.11 12.28.12 12.27.13

Weight Watchers International, Inc. S&P 500 Index S&P MidCap 400 Index

S&P 50

S&P MidCap

W