WeightWatchers 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

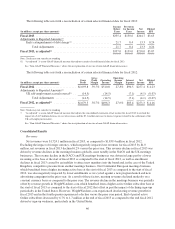

Fiscal 2014: Anticipated Business Metrics, Trends and Other Events

Due to increasing competitive pressures, including the impact of the increasing consumer trial of activity

monitors and free apps in the commercial weight loss category, and less impactful marketing of our new two-

week starter plan, Simple Start, management anticipates negative recruitment trends to continue into 2014. Given

the lower starting active base at the beginning of fiscal 2014 versus the beginning of fiscal 2013 and the weak

recruitment environment continuing into 2014, management expects declines in paid weeks in fiscal 2014 to be

higher than the declines experienced in fiscal 2013. Management expects Online paid weeks in fiscal 2014 to

decline at a higher rate than that experienced in the second half of fiscal 2013. For NACO, the United Kingdom

and Continental Europe, management anticipates meeting paid weeks and attendances in fiscal 2014 to decline at

a higher rate than that experienced in fiscal 2013. Given these expected negative trends, management expects

revenues to decline at a higher rate in fiscal 2014 than that experienced in fiscal 2013.

To help offset this anticipated revenue decline, our strategy for fiscal 2014 includes investments in certain

key areas to support future growth and plans to reduce costs aggressively elsewhere. As part of this cost savings

initiative, the Company is undertaking a plan of termination which will result in the elimination of certain

positions and employees worldwide. In connection with this plan, the Company anticipates recording

restructuring charges in connection with employee termination benefit costs of approximately $10.0 million

(which is expected to be divided equally between general and administrative expenses and operating expenses

related to field restructuring) during the first and second quarters of fiscal 2014.

Margins

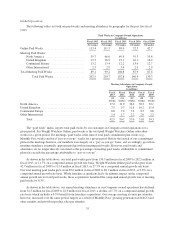

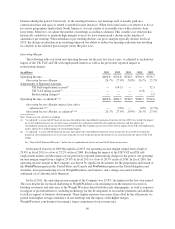

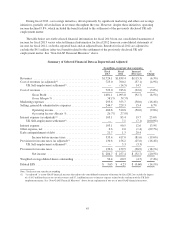

Gross Margin

The following table sets forth our gross profit and gross margin for the past five fiscal years, as adjusted to

exclude the impact of the UK VAT and the UK self-employment matters:

(in millions) 2013 2012 2011 2010 2009

Gross Profit ...................................... $1,001.1 $1,093.8 $1,058.5 $800.8 $740.8

Gross Margin ................................ 58.1% 59.5% 57.8% 54.7% 52.4%

Adjustments to Reported Amounts

UK self-employment accrual(1) ............... — (14.5) — — 32.5

UK VAT ruling accrual(2) ................... — — — (2.0) —

Gross Profit, as adjusted(1)(2) ......................... $1,001.1 $1,079.3 $1,058.5 $798.8 $773.3

Gross Margin impact from above adjustments(1)(2) .... — 0.8% — 0.0% (2.3%)

Gross Margin, as adjusted(1)(2) ................... 58.1% 58.7% 57.8% 54.6% 54.7%

Note: Totals may not sum due to rounding

(1) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of net income for fiscal 2012 to exclude the

impact of a $14.5 million decrease to cost of revenues related to the settlement of the UK self-employment matter and that adjusts the

consolidated statements of net income for fiscal 2009 to exclude $32.5 million in cost of revenues for the impact of the UK self-

employment matter.

(2) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of net income for fiscal 2010 to exclude the

benefit of a $2.0 million increase to revenues from the reversal of the previously disclosed over-accrual related to the adverse UK VAT

ruling.

See “Non-GAAP Financial Measures” below for an explanation of our use of non-GAAP financial measures.

In the period from fiscal 2009 through fiscal 2013 our gross margin ranged from a high of 59.5% in fiscal

2012 to a low of 52.4% in fiscal 2009. Excluding the impact of the UK VAT and UK self-employment matters in

the period, our gross margin ranged from a high of 58.7% in fiscal 2012 to a low of 54.6% in fiscal 2010. As the

higher margin WeightWatchers.com business grew over the period and became a larger share of our revenue

mix, our adjusted gross margin expanded, most notably from fiscal 2010 through fiscal 2012. In addition, with its

fixed cost business model, growth within the WeightWatchers.com business resulted in margin expansion in that

39