WeightWatchers 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

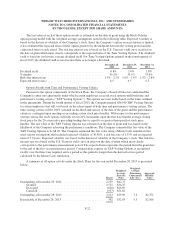

At December 28, 2013, the Company had $2,388,000 outstanding under the WWI Credit Facility, consisting

entirely of term loans and there were no loans outstanding under the Revolving Facility. In addition, at

December 28, 2013, the Revolving Facility had $1,554 in issued but undrawn letters of credit outstanding

thereunder and $248,446 in available unused commitments thereunder. The proceeds from borrowings under the

Revolving Facility (including swing line loans and letters of credit) will be used for working capital and general

corporate purposes.

Borrowings under the New Credit Agreement bear interest at a rate equal to, at the Company’s option,

LIBOR plus an applicable margin or a base rate plus an applicable margin. LIBOR under the Tranche B-2 Term

Facility is subject to a minimum interest rate of 0.75% and the base rate under the Tranche B-2 Term Facility is

subject to a minimum interest rate of 1.75%. The applicable margin relating to both of the Term Facilities will

increase by 25 basis points in the event that the Company receives a corporate rating of BB- (or lower) from S&P

and a corporate rating of Ba3 (or lower) from Moody’s. The applicable margin relating to the Revolving Facility

will fluctuate depending upon the Company’s Consolidated Leverage Ratio (as defined in the New Credit

Agreement). At December 28, 2013, borrowings under the Tranche B-1 Term Facility bore interest at LIBOR

plus an applicable margin of 2.75% and borrowings under the Tranche B-2 Term Facility bore interest at LIBOR

plus an applicable margin of 3.00%. At the Company’s Consolidated Leverage Ratio as of December 28, 2013,

had there been any borrowings under the Revolving Facility, it would have borne interest at LIBOR plus an

applicable margin of 2.25% or base rate plus an applicable margin of 1.25%. On a quarterly basis, the Company

will pay a commitment fee to the lenders under the Revolving Facility in respect of unutilized commitments

thereunder, which commitment fee will fluctuate depending upon the Company’s Consolidated Leverage Ratio.

At the Company’s Consolidated Leverage Ratio as of December 28, 2013, the commitment fee was 0.40% per

annum. The Company also will pay customary letter of credit fees and fronting fees under the Revolving Facility.

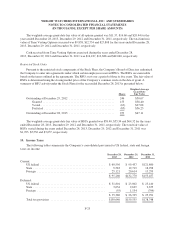

The New Credit Agreement contains customary covenants including covenants that, in certain

circumstances, restrict the Company’s ability to incur additional indebtedness, pay dividends on and redeem

capital stock, make other payments, including investments, sell its assets and enter into consolidations, mergers

and transfers of all or substantially all of its assets. The Revolving Facility requires the Company to not exceed a

specified Consolidated Leverage Ratio, but only if borrowings under the Revolving Facility exceed 20.0% of

revolving commitments as of the end of such fiscal quarter. As of December 28, 2013, borrowings in excess of

$50,000 would require us to not exceed such ratio. As of December 28, 2013, there were no borrowings under

our Revolving Facility and total letters of credit issued were $1,554. The Term Facilities do not require the

Company to maintain any financial ratios. The WWI Credit Facility is guaranteed by certain of the Company’s

existing and future subsidiaries. Substantially all of the Company’s assets secure the WWI Credit Facility.

At December 28, 2013 and December 29, 2012, the Company’s debt consisted entirely of variable-rate

instruments. Interest rate swaps were entered into to hedge a portion of the cash flow exposure associated with

the Company’s variable-rate borrowings. The average interest rate on the Company’s debt, exclusive of the

impact of swaps, was approximately 3.65% and 2.99% per annum at December 28, 2013 and December 29,

2012, respectively. The average interest rate on our debt, including the impact of swaps, was approximately

4.08% and 3.50% per annum at December 28, 2013 and December 29, 2012, respectively.

F-18