WeightWatchers 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

principal amount of the Term B Loan and $119.1 million in aggregate principal amount of the Term D Loan were

converted into, and $600.0 million in aggregate principal amount of commitments to borrow new term loans

were provided under, a new tranche F loan, or Term F Loan, and (iii) $262.0 million in aggregate principal

amount of commitments under the Revolver A-1 were converted into a new revolving credit facility, or Revolver

A-2. The loans outstanding under each term loan facility existing prior to the amendment of the our then existing

WWI Credit Facility and the loans and commitments outstanding under the Revolver A-1, in each case that were

not converted into the Term E Loan, the Term F Loan or the Revolver A-2, as applicable, continued to remain

outstanding under our then existing WWI Credit Facility as the Term A-1 Loan, the Term B Loan, the Term C

Loan, the Term D Loan or the Revolver A-1, as applicable. In connection with this amendment, we incurred fees

of approximately $26.2 million in the first quarter of fiscal 2012. On March 27, 2012, we borrowed an aggregate

of $726.0 million under the Term E Loan and the Term F Loan to finance the purchase of shares in the Tender

Offer and to pay a portion of the related fees and expenses. On April 9, 2012, we borrowed an aggregate of

approximately $723.4 million under the Term E Loan to finance the purchase of shares from Artal Holdings.

Dividends

On October 30, 2013, we announced that we suspended our quarterly cash dividend. As a result, no dividend

was issued for the fourth quarter of fiscal 2013. We historically had issued a quarterly cash dividend of $0.175

per share of our common stock every quarter for the past several fiscal years. We currently intend to use the

annual cash savings from such dividend suspension to preserve financial flexibility while funding our strategic

growth initiatives and building cash for future debt repayments. Any future determination to declare and pay

dividends will be made at the discretion of our Board of Directors, after taking into account our financial results,

capital requirements and other factors it may deem relevant. The WWI Credit Facility also contains restrictions

on our ability to pay dividends on our common stock.

The WWI Credit Facility provides that we are permitted to pay dividends and extraordinary dividends, as

well as repurchase shares of our common stock, so long as we are not in default under the WWI Credit Facility

agreement. However, payment of extraordinary dividends and stock repurchases shall not exceed $100.0 million

in the aggregate in any fiscal year if the Consolidated Leverage Ratio is greater than 3.25:1. As of December 28,

2013, our Consolidated Leverage Ratio was greater than 3.25:1 and we expect that it will remain above 3.25:1 for

the foreseeable future.

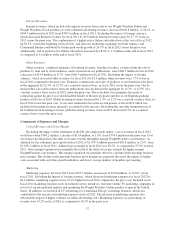

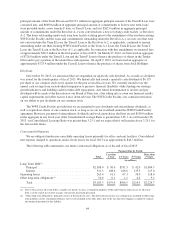

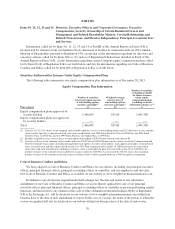

Contractual Obligations

We are obligated under non-cancelable operating leases primarily for office and rent facilities. Consolidated

rent expense charged to operations under all our leases for fiscal 2013 was approximately $46.3 million.

The following table summarizes our future contractual obligations as of the end of fiscal 2013:

Payment Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

(in millions)

Long-Term Debt(1)

Principal .................................... $2,388.0 $ 30.0 $331.5 $ 42.0 $1,984.5

Interest ..................................... 521.3 108.4 166.6 133.3 113.0

Operating leases .................................. 265.4 41.1 67.3 39.0 118.0

Other long-term obligations(2) ....................... 10.6 0.1 1.1 0.2 9.2

Total ....................................... $3,185.3 $179.6 $566.5 $214.5 $2,224.7

(1) Due to the fact that all of our debt is variable rate based, we have assumed for purposes of this table that the interest rate on all of our

debt as of the end of fiscal 2013 remains constant for all periods presented.

(2) “Other long-term obligations” primarily consist of deferred rent costs. The provision for income tax contingencies included in other long-

term liabilities on the consolidated balance sheet is not included in the table above due to the fact that the Company is unable to estimate

the timing of payment for this liability.

64