WeightWatchers 2013 Annual Report Download - page 51

Download and view the complete annual report

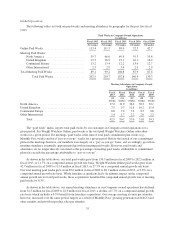

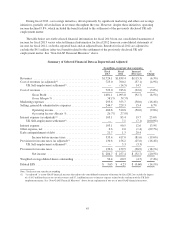

Please find page 51 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.quarter of fiscal 2010. For the first, second, third and fourth quarters of fiscal 2011, meeting paid weeks

increased 32.6%, 31.9%, 25.9% and 15.0% and attendances increased 33.1%, 19.8%, 13.6% and 5.5%,

respectively, as compared to the prior year periods.

In fiscal 2012, NACO meeting paid weeks decreased 5.6% and attendances decreased 11.4% versus the

prior year level. Although we entered fiscal 2012 with more active members than at the beginning of fiscal 2011,

we experienced lower enrollments in the first quarter of fiscal 2012 as we cycled against the historically high

levels of recruitment growth in the first quarter of fiscal 2011. The decline in enrollments in the first quarter of

fiscal 2012, caused in part by lack of new program news and execution challenges associated with introducing

Monthly Pass in the small accounts portion of its corporate business, drove a meeting paid weeks decline of 6.0%

and an attendance decline of 11.9%, and also resulted in entering the second quarter of fiscal 2012 with a lower

meeting membership base, as compared to the prior year period. The declining trend in meeting paid weeks and

attendance in fiscal 2012 continued through the remainder of the year. For the second, third and fourth quarters

of fiscal 2012, meeting paid weeks decreased 5.5%, 3.6% and 7.3% and attendances decreased 9.9%, 9.4% and

14.5%, respectively, as compared to the prior year periods.

In fiscal 2013, NACO meeting paid weeks decreased 9.4% and attendances decreased 14.7% versus the prior

year level. The decline in meeting paid weeks primarily resulted from the lower meetings active base at the

beginning of fiscal 2013 versus the beginning of fiscal 2012 as well as from lower enrollments in fiscal 2013 versus

the prior year, primarily in the United States, due to the difficulty in attracting members to our brand. Although we

introduced our new Weight Watchers 360° plan in December 2012, this new plan was not as effective in driving

consumer trial as our PointsPlus innovation. For the first, second, third and fourth quarters of fiscal 2013, meeting

paid weeks decreased 6.5%, 10.0%, 10.7% and 10.8% and attendances decreased 15.9%, 14.5%, 14.7% and 13.1%,

respectively, as compared to the prior year periods. The Company completed three franchise acquisitions in NACO

in the second half of fiscal 2012 as well as seven franchise acquisitions in fiscal 2013. These franchise acquisitions

benefitted NACO meeting paid weeks by 1.7% and attendances by 2.8% in fiscal 2013.

United Kingdom Meeting Metrics and Business Trends

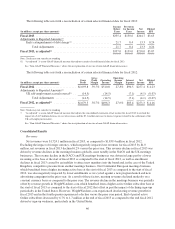

Despite a weak economy in the United Kingdom in fiscal 2009, effective marketing and promotional

activity resulted in an increase in meeting paid weeks, up 8.1% in fiscal 2009 as compared to the prior year,

reflecting increased penetration of Monthly Pass in that market. Attendance in fiscal 2009 declined slightly,

down 1.5% versus the prior year.

In fiscal 2010, meeting paid weeks declined by 0.4%, and meeting attendance declined 10.5%, compared to

fiscal 2009. First quarter fiscal 2010 UK volumes were significantly impacted by weather and cycling against a

program innovation in the prior year. The United Kingdom continued to experience steep declines in attendance

in 2010 versus the prior year, down 8.5% in the second quarter and 9.4% in the third quarter. The United

Kingdom launched its new program, ProPoints, in early November 2010, and saw attendance growth as a result

of the launch. However, because of limited marketing prior to the new program launch and bad weather during

the launch period, fourth quarter 2010 attendance decreased 11.3% versus the fourth quarter of fiscal 2009.

In fiscal 2011, meeting paid weeks grew 18.3% versus the prior year, benefiting from enrollment growth

concurrent with the launch of ProPoints late in fiscal 2010 and early fiscal 2011 and an increase in Monthly Pass

penetration. As with NACO, this growth in recruitment resulted in a larger customer base and as a result,

attendances also grew, up 13.7% versus the prior year. Despite the negative impact of the Royal Wedding and

Easter timing on second quarter fiscal 2011 attendance, meeting paid weeks and attendance grew in each fiscal

2011 quarter versus the prior year period.

In fiscal 2012, meeting paid weeks declined 11.3% and attendances decreased 16.5% versus the prior year

level. As with NACO, the United Kingdom entered fiscal 2012 with more active members as compared to the

beginning of fiscal 2011, but experienced lower enrollments in the first quarter of fiscal 2012 versus the prior

year period. These lower enrollments were driven by cycling against the historically high recruitment levels in

37