WeightWatchers 2013 Annual Report Download - page 58

Download and view the complete annual report

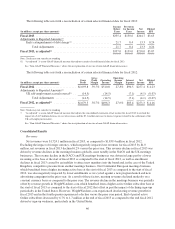

Please find page 58 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.term U.S. Treasury securities. The market risk premium is generally determined by reviewing external market

data. When appropriate, we further adjust the resulting combined rate to account for certain entity-specific

factors such as maturity of the market in order to determine the utilized discount rate. The cost of debt is our

average borrowing rate for the period. The discount rates used in our fiscal 2013 year-end impairment test and

our fiscal 2012 year-end impairment test averaged approximately 9.1% and 9.2%, respectively.

At the end of fiscal 2013, we estimated that approximately 99% of our goodwill and 87% of our franchise

rights acquired had a fair value at least 50% higher than their respective carrying amounts. In the United States,

the region which held approximately 41% of the goodwill and 83% of the franchise rights acquired, the aggregate

fair value of both our reporting units and franchise rights acquired was at least 50% higher than the aggregate

carrying value of the reporting units and franchise rights acquired, respectively. Given that there is a significant

difference between the fair value and carrying value of our franchise rights acquired, we believe there are

currently no reasonably likely changes in assumptions that would cause a material impairment charge.

Information concerning significant accounting policies affecting us is set forth in Note 2 of our consolidated

financial statements, contained in Part IV, Item 15 of this Annual Report on Form 10-K.

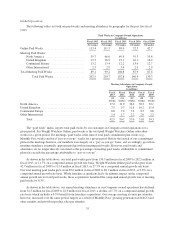

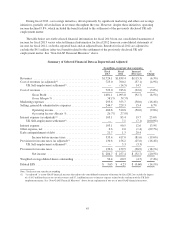

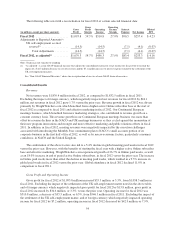

RESULTS OF OPERATIONS FOR FISCAL 2013 (52 weeks) COMPARED TO FISCAL 2012 (52 weeks)

OVERVIEW

Fiscal 2012 was a year of modest revenue growth of 0.4%, with growth in the Online business almost fully

offset by declines in the meetings business. In fiscal 2012, total paid weeks continued to grow at a decelerating

rate in each fiscal quarter versus the prior year period due to a challenging recruitment environment, particularly

from our global meetings business.

This challenging recruitment environment continued for both the Online and meetings businesses into fiscal

2013, with increased competitive pressure in the Online business from the increasing consumer trial of activity

monitors and free apps. As we entered fiscal 2013, our meetings business active base was lower than the

beginning of fiscal 2012. Conversely, though our active Online subscriber base had a declining growth trend

throughout fiscal 2012, this subscriber base was higher at the beginning of fiscal 2013 than at the beginning of

fiscal 2012. The difficult recruitment environment in fiscal 2013 had the impact of further reducing the active

bases in both our meetings and Online businesses as we progressed through fiscal 2013.

Each fiscal 2013 quarter had consistently weak and deteriorating recruitment performance, which further

drove declining active bases, as compared to the prior year period resulting in paid weeks and revenue trends that

became progressively worse throughout the year with the fourth quarter of fiscal 2013 having the weakest

performance. In the first quarter of fiscal 2013, total paid weeks were still above the prior year period by

1.4%. However, in the second, third and fourth quarters of fiscal 2013, driven by this negative recruitment trend,

total paid weeks declined 2.5%, 6.6% and 8.5%, respectively, as compared to the prior year period. Online paid

weeks in the third quarter of fiscal 2013 declined 2.6% versus the prior year period. This was the first time in our

history that Online paid weeks declined on a year-over-year basis.

Driven by the decline in paid weeks, total revenue for fiscal 2013 declined 6.3% as compared to the prior

year. This revenue decrease was driven primarily by the meetings business where revenue declined in all four

quarters versus the respective prior year periods, with a full year decline of 10.1% versus the prior year.

Conversely, Online revenues grew in the first three quarters, but at decelerating rates, such that by the fourth

quarter of fiscal 2013, our Online business had its first-ever quarter of declining revenue versus the prior year

period, down 5.2%. However, for the full year of fiscal 2013, Online revenues increased 3.5% versus the prior

year.

44