WeightWatchers 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

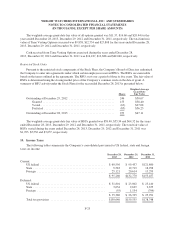

In December 2011, HMRC’s claim in respect of NIC was amended to increase the claimed amount for the

period April 2002 to April 2007 and include the interest accrued thereon through December 2011. In addition, in

February 2012, HMRC asserted a claim in respect of PAYE for the period April 2007 to April 2011 similar to

what it had claimed for the period April 2001 to April 2007. The Company was granted permission to appeal this

PAYE claim with the First Tier Tribunal and the First Tier Tribunal directed that the appeal be stayed until

following the decision of the UK Court of Appeal with respect to the Company’s appeal of the Upper Tribunal’s

ruling.

In light of the First Tier Tribunal’s adverse ruling and in accordance with accounting guidance for

contingencies, the Company recorded in the fourth quarter of fiscal 2009 a reserve for the period from April 2001

through the end of fiscal 2009, inclusive of estimated accrued interest. On a quarterly basis, beginning in the first

quarter of fiscal 2010 and through the second quarter of fiscal 2011, the Company recorded a reserve for UK

withholding taxes with respect to its UK leaders consistent with this ruling. The reserve at the end of the second

quarter of fiscal 2011 equaled approximately $43,671 in the aggregate based on the exchange rates at the end of

fiscal 2011. As of the beginning of the third quarter of fiscal 2011, the Company began employing its UK leaders

and therefore has ceased recording any further reserves for this matter. In February 2012, the Company paid

HMRC, on a without prejudice basis, a portion of the amount previously reserved equal to approximately

$30,018 based on the exchange rates at the payment date for estimated amounts claimed to be owed by the

Company with respect to PAYE and interest thereon for the period April 2001 to July 2011. In December 2012,

the Company reached an agreement with HMRC to settle the matter in its entirety for approximately $36,770. In

January 2013, $6,752 was paid to HMRC, representing the balance due over the amount previously paid to

HMRC in February 2012. In January 2013, the UK Court of Appeal dismissed the case and the First Tier

Tribunal confirmed withdrawal of the Company’s appeal against HMRC.

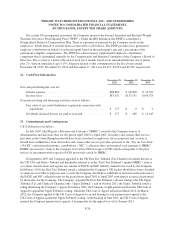

Other Litigation Matters

Due to the nature of the Company’s activities, it is also, at times, subject to pending and threatened legal

actions that arise out of the ordinary course of business. In the opinion of management, based in part upon advice

of legal counsel, the disposition of any such matters is not expected to have a material effect on the Company’s

results of operations, financial condition or cash flows.

Lease Commitments

Minimum rental commitments under non-cancelable operating leases, primarily for office and rental

facilities, at December 28, 2013, consist of the following:

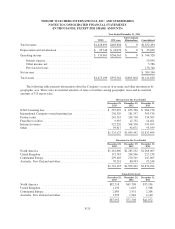

2014 ............................................................ $ 41,095

2015 ............................................................ 36,642

2016 ............................................................ 30,704

2017 ............................................................ 22,076

2018 ............................................................ 16,898

2019 and thereafter ................................................. 118,001

Total ........................................................ $265,416

Total rent expense charged to operations under these leases for the fiscal years ended December 28,

2013, December 29, 2012 and December 31, 2011 was $46,300, $40,485 and $36,572, respectively.

F-27