WeightWatchers 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

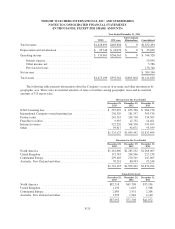

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

16. Derivative Instruments and Hedging

As of December 28, 2013 and December 29, 2012, the Company had in effect an interest rate swap with a

notional amount totaling $466,250 and $583,250, respectively. In January 2009, the Company entered into this

forward-starting interest rate swap with an effective date of January 4, 2010 and a termination date of January 27,

2014. During the term of this forward-starting interest rate swap, the notional amount fluctuated, but was no

higher than the amount outstanding as of the end of fiscal 2013. The initial notional amount was $425,000 and

the highest notional amount was $755,000. Effective April 2, 2013, due to the Company’s debt refinancing, the

Company ceased the application of hedge accounting for this swap. Accordingly, changes in the fair value of this

swap have been recorded in earnings subsequent to April 2, 2013 and were immaterial for the fiscal year ended

December 28, 2013.

On July 26, 2013, in order to hedge an additional portion of its variable rate debt, the Company entered into

a forward-starting interest rate swap with an effective date of March 31, 2014 and a termination date of April 2,

2020. The initial notional amount of this swap is $1,500,000. During the term of this swap, the notional amount

will decrease from $1,500,000 effective March 31, 2014 to $1,250,000 on April 3, 2017 with a further reduction

to $1,000,000 on April 1, 2019. This interest rate swap effectively fixes the variable interest rate on the notional

amount of this swap at 2.38%. This swap qualifies for hedge accounting and, therefore, changes in the fair value

of this swap have been recorded in accumulated other comprehensive income (loss).

As of December 28, 2013 and December 29, 2012, cumulative unrealized losses for qualifying hedges were

reported as a component of accumulated other comprehensive income (loss) in the amounts of $4,603 ($7,546

before taxes) and $6,602 ($10,824 before taxes), respectively.

The Company is hedging forecasted transactions for periods not exceeding the next seven years. The

Company expects approximately $12,017 ($19,700 before taxes) of derivative losses included in accumulated

other comprehensive income (loss) at December 28, 2013, based on current market rates, will be reclassified into

earnings within the next 12 months.

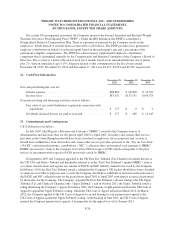

17. Accumulated Other Comprehensive Income

Amounts reclassified out of accumulated other comprehensive income are as follows:

Changes in Accumulated Other Comprehensive Income by Component(a)

Fiscal year ended December 28, 2013

Loss on

Qualifying

Hedges

Foreign

Currency

Translation

Adjustments Total

Beginning Balance at December 29, 2012 ............................ $(6,602) $19,461 $ 12,859

Other comprehensive loss before reclassifications, net of tax ......... (4,124) (6,341) (10,465)

Amounts reclassified from accumulated other comprehensive income,

net of tax(b) .............................................. 6,123 0 6,123

Net current period other comprehensive income (loss) .................. 1,999 (6,341) (4,342)

Ending Balance at December 28, 2013 ............................... $(4,603) $13,120 $ 8,517

(a) Amounts in parentheses indicate debits

(b) See separate table below for details about these reclassifications

F-31