WeightWatchers 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

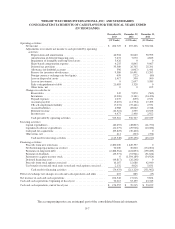

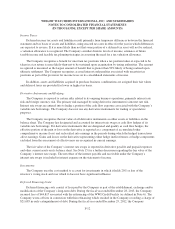

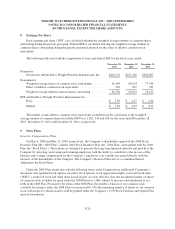

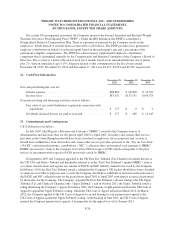

The carrying amount of finite-lived intangible assets as of December 28, 2013 and December 29, 2012 was

as follows:

December 28, 2013 December 29, 2012

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Capitalized software costs ............................ $ 85,095 $ 62,418 $ 86,857 $ 54,134

Trademarks ........................................ 10,691 9,955 10,342 9,615

Website development costs ........................... 69,660 48,060 57,042 38,357

Other ............................................. 7,021 6,737 7,034 6,689

$172,467 $127,170 $161,275 $108,795

As described in Note 2, in fiscal 2013, the Company recorded an impairment charge of $1,235 for

amortizable intangible assets related to the shutdown of its China operations and an impairment charge of $2,653

related to internal-use computer software that was not expected to provide substantive service potential.

Estimated amortization expense of existing finite-lived intangible assets for the next five fiscal years is as

follows:

2014 ............................................................. $20,841

2015 ............................................................. $14,997

2016 ............................................................. $ 7,593

2017 ............................................................. $ 1,765

2018 and thereafter .................................................. $ 101

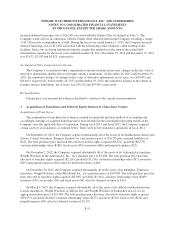

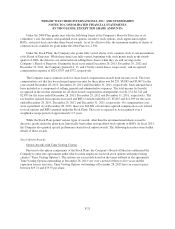

5. Property and Equipment

The components of property and equipment were:

December 28,

2013

December 29,

2012

Equipment ................................................. $123,210 $ 113,301

Leasehold improvements ...................................... 77,771 70,229

200,981 183,530

Less: Accumulated depreciation and amortization .................. (113,929) (111,762)

$ 87,052 $ 71,768

As described in Note 2, in fiscal 2013, the Company commenced the shutdown of its China operations and,

as a result, recorded an impairment charge of $372 related to property, plant and equipment.

Depreciation and amortization expense of property and equipment for the fiscal years ended December 28,

2013, December 29, 2012 and December 31, 2011 was $20,342, $18,844 and $14,450, respectively.

F-16