WeightWatchers 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate. We believe that cash flows from operating activities, together with borrowings available under our

Revolver, will be sufficient for the next 12 months to fund currently anticipated capital expenditure requirements,

debt service requirements and working capital requirements.

Franchise Acquisitions

We did not acquire any franchises in fiscal 2011. In fiscal 2012 and fiscal 2013, we made the following

franchise acquisitions:

In September 2012, we acquired substantially all of the assets of our Southeastern Ontario and Ottawa,

Canada franchisee, Slengora Limited, for a net purchase price of $16.8 million.

In November 2012, we acquired substantially all of the assets of our Adirondacks franchisee, Weight

Watchers of the Adirondacks, Inc., for a purchase price of $3.4 million.

In December 2012, we acquired substantially all of the assets of our Memphis, Tennessee franchisee,

Weight Watchers of the Mid-South, Inc., for a purchase price of $10.0 million.

In March 2013, we acquired substantially all of the assets of our Alberta and Saskatchewan, Canada

franchisees, Weight Watchers of Alberta Ltd. and Weight Watchers of Saskatchewan Ltd., for an aggregate

purchase price of $35.0 million.

In July 2013, we acquired substantially all of the assets of our West Virginia franchisee, Weight Watchers

of West Virginia, Inc., for a net purchase price of $16.0 million, our Columbus, Ohio franchisee, Weight

Watchers of Columbus, Inc., for a net purchase price of $23.3 million and our Reno, Nevada franchisee, Weight

Watchers of Northern Nevada, Inc., for a net purchase price of $4.0 million.

In October 2013, we acquired substantially all of the assets of our Manitoba, Canada franchisee, Weight

Watchers of Manitoba Ltd., for a net purchase price of $5.2 million and our Franklin and St. Lawrence Counties,

New York franchisee, Weight Watchers of Franklin and St. Lawrence Counties Inc., for a net purchase price of

$0.3 million.

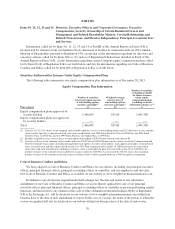

Stock Transactions

On October 9, 2003, our Board of Directors authorized and we announced a program to repurchase up to

$250.0 million of our outstanding common stock. On each of June 13, 2005, May 25, 2006 and October 21, 2010,

our Board of Directors authorized and we announced adding $250.0 million to this program. The repurchase

program allows for shares to be purchased from time to time in the open market or through privately negotiated

transactions. No shares will be purchased from Artal Holdings and its parents and subsidiaries under this

program. The repurchase program currently has no expiration date. During the twelve months ended

December 28, 2013 and December 29, 2012, the Company repurchased no shares of its common stock in the

open market under this program. The repurchase of shares of common stock under the Tender Offer and from

Artal Holdings pursuant to the Purchase Agreement, as discussed further below, was not made pursuant to the

repurchase program. During the twelve months ended December 31, 2011, the Company repurchased in its first

quarter 0.8 million shares of its common stock in the open market under this program for a total cost of $31.6

million, and in its second, third and fourth quarters no shares of its common stock under this program.

On February 23, 2012, we commenced a “modified Dutch auction” tender offer for up to $720.0 million in

value of our common stock at a purchase price not less than $72.00 and not greater than $83.00 per share, or the

Tender Offer. Prior to the Tender Offer, on February 14, 2012, we entered into an agreement, or the Purchase

65