WeightWatchers 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

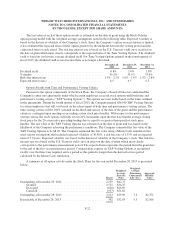

Under the 2004 Plan, grants may take the following forms at the Company’s Board of Directors or its

committee’s sole discretion: non-qualified stock options, incentive stock options, stock appreciation rights,

RSUs, restricted stock and other share-based awards. As of its effective date, the maximum number of shares of

common stock available for grant under the 2004 Plan was 2,500.

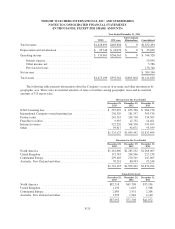

Under the Stock Plans, the Company also grants fully-vested shares of its common stock to certain members

of its Board of Directors. While these shares are fully vested, beginning with stock grants made in the fourth

quarter of 2006, the directors are restricted from selling these shares while they are still serving on the

Company’s Board of Directors. During the fiscal years ended December 28, 2013, December 29, 2012 and

December 31, 2011, the Company granted 14, 13, and 13 fully-vested shares, respectively, and recognized

compensation expense of $524, $707 and $772, respectively.

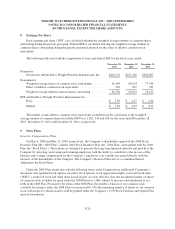

The Company issues common stock for share-based compensation awards from treasury stock. The total

compensation cost that has been charged against income for these plans was $4,255, $8,845 and $9,067 for the

years ended December 28, 2013, December 29, 2012 and December 31, 2011, respectively. Such amounts have

been included as a component of selling, general and administrative expenses. The total income tax benefit

recognized in the income statement for all share-based compensation arrangements was $1,174, $2,742 and

$2,895 for the years ended December 28, 2013, December 29, 2012 and December 31, 2011, respectively. The

tax benefits realized from options exercised and RSUs vested totaled $4,217, $5,847 and $11,309 for the years

ended December 28, 2013, December 29, 2012 and December 31, 2011, respectively. No compensation costs

were capitalized. As of December 28, 2013, there was $24,881 of total unrecognized compensation cost related

to stock options and RSUs granted under the Stock Plans. That cost is expected to be recognized over a

weighted-average period of approximately 2.5 years.

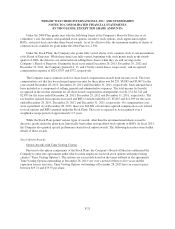

While the Stock Plans permit various types of awards, other than the aforementioned shares issued to

directors, grants under the plans have historically been either non-qualified stock options or RSUs. In fiscal 2013,

the Company also granted special performance-based stock option awards. The following describes some further

details of these awards.

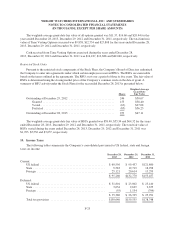

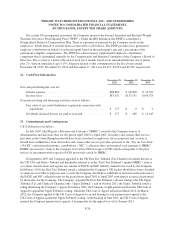

Stock Option Awards

Option Awards with Time Vesting Criteria

Pursuant to the option components of the Stock Plans, the Company’s Board of Directors authorized the

Company to enter into agreements under which certain employees received stock options with time vesting

criteria (“Time Vesting Options”). The options are exercisable based on the terms outlined in the agreements.

Time Vesting Options outstanding at December 28, 2013 vest over a period of three to five years and the

expiration term is ten years. Time Vesting Options outstanding at December 28, 2013 have an exercise price

between $19.74 and $79.55 per share.

F-21