WeightWatchers 2013 Annual Report Download - page 61

Download and view the complete annual report

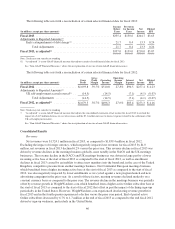

Please find page 61 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The combination of declining recruitments and the lower incoming active base at the start of fiscal 2013 in

the meetings business led to a decline in global meeting paid weeks in fiscal 2013 versus the prior year. With the

benefit of starting fiscal 2013 with a higher active Online subscriber base, WeightWatchers.com experienced

growth of 1.7% in Online paid weeks versus the prior fiscal year. The increase in Online paid weeks did not fully

offset the decline in meeting paid weeks, resulting in a 3.9% decrease in global paid weeks in fiscal 2013 versus

the prior year. Global attendance in fiscal 2013 declined 15.5% in comparison to fiscal 2012.

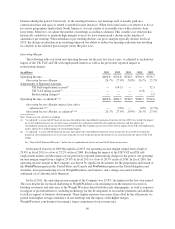

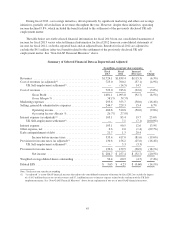

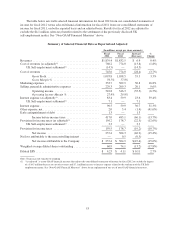

Gross Profit and Operating Income

Gross profit for fiscal 2013 of $1,001.1 million decreased $92.7 million, or 8.5%, from $1,093.8 million in

fiscal 2012. Excluding the impact of the settlement in fiscal 2012 of the UK self-employment matter noted in the

above table, and of foreign currency which negatively impacted gross profit for fiscal 2013 by $0.3 million, gross

profit in fiscal 2013 decreased by $77.9 million, or 7.2%, versus the prior year. Operating income for fiscal 2013

was $460.8 million, a decrease of $50.0 million, or 9.8%, from $510.8 million in fiscal 2012. Excluding the

impact of the settlement in fiscal 2012 of the UK self-employment matter and of foreign currency which

negatively impacted operating income for fiscal 2013 by $0.5 million, operating income in fiscal 2013 decreased

by $35.0 million, or 7.0%, versus the prior year. This decrease in operating income was primarily the result of

lower meeting revenues in fiscal 2013 versus the prior year that were partially offset by lower marketing

expense, primarily from the elimination of inefficient digital advertising and the lack of a men’s campaign in the

United States, in fiscal 2013. As adjusted for the settlement in fiscal 2012, our gross margin in fiscal 2013

decreased to 58.1% from 58.7% in fiscal 2012, and operating income margin in fiscal 2013 decreased to 26.7%

from 27.0% in fiscal 2012. See “—Components of Expenses and Margins” for additional details.

Net Income and Earnings Per Share

Net income in fiscal 2013 declined 20.5% from $257.4 million in fiscal 2012 to $204.7 million. This decline

in net income was driven by the decrease in operating income in fiscal 2013 versus the prior year as well as a

charge of $21.7 million in early extinguishment of debt and higher interest expense resulting from our long-term

debt refinancing in the second quarter of fiscal 2013. Excluding this early extinguishment of debt charge (after

tax), net income would have been $218.0 million in fiscal 2013.

Earnings per fully diluted share in fiscal 2013 were $3.63, a decrease of $0.60 from $4.23 in fiscal 2012.

Excluding the early extinguishment of debt charge, EPS would have been $3.87 in fiscal 2013. EPS in fiscal

2013 benefited from our repurchase of shares in the Tender Offer and the related share repurchase from Artal

Holdings as the number of our weighted average diluted shares outstanding for fiscal 2013 decreased to

56.4 million from 60.9 million in the prior year. See “—Liquidity and Capital Resources—Stock Transactions”

for a description of the Tender Offer and related share repurchase from Artal Holdings.

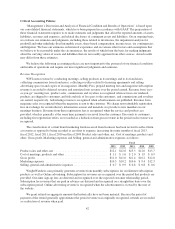

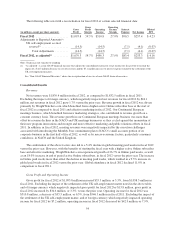

Components of Revenue and Volumes

We derive our revenues principally from meeting fees, Internet revenues, products sold in meetings, and

licensed products sold in retail channels. In addition, we generate other revenue from royalties paid to us by our

franchisees, subscriptions to our branded magazines, and advertising in our publications.

Meeting Fees

Global meeting fees for fiscal 2013 were $851.6 million, a decrease of $83.3 million, or 8.9%, from $934.9

million in the prior year. Excluding the impact of foreign currency, which decreased our global meeting fees for

fiscal 2013 by $0.7 million, global meeting fees in fiscal 2013 decreased by 8.8% versus the prior year. The

decline in meeting fees was driven by a 10.1% decline in global meeting paid weeks in fiscal 2013 to

89.1 million from 99.2 million in the prior year. The decline in meeting paid weeks was driven by a lower

meetings active base at the beginning of fiscal 2013 versus the beginning of fiscal 2012 as well as by the lower

47