WeightWatchers 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WeightWatchers.com Metrics and Business Trends

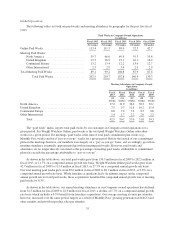

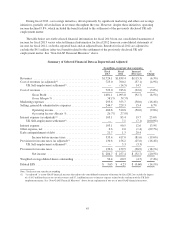

From fiscal 2009 to fiscal 2013, Internet revenues grew at a compound annual growth rate of 27.8%. This

growth was primarily driven by growth in Online subscription revenue of 29.1% on a compound annual growth

rate basis from fiscal 2009 to fiscal 2013. Subscription revenue growth was driven by an increase in Online paid

weeks from 42.7 million in fiscal 2009 to 113.4 million in fiscal 2013, a compound annual growth rate of 27.7%.

End of period active Online subscribers grew from 0.8 million at the end of fiscal 2009 to 1.7 million at the end

of fiscal 2013, a compound annual growth rate of 23.0%. This successful growth resulted primarily from a

combination of new subscribers in our major markets and launches of WeightWatchers.com subscription

products in three new markets. In addition, WeightWatchers.com, like the meetings business, benefited from the

new program launches of PointsPlus and ProPoints in fiscal 2010 and fiscal 2011 and the introduction of new

products, including applications for mobile devices such as the iPhone®, iPad®and Android™ devices.

Marketing, particularly first-time dedicated television advertising coupled with effective marketing campaigns in

Canada and Continental Europe in the case of fiscal 2012, continued to drive subscription growth from fiscal

2009 through the first three quarters of fiscal 2013. Although Online paid weeks still grew in fiscal 2013 as

compared to fiscal 2012, driven by a higher active Online subscriber base at the beginning of fiscal 2013 versus

fiscal 2012, the declining trend of Online paid weeks growth in fiscal 2012 continued into fiscal 2013. For the

first and second quarters of fiscal 2013, Online paid weeks grew 10.3% and 4.4% versus the prior year period,

respectively. Conversely, for the third and fourth quarters of fiscal 2013, Online paid weeks declined 2.6% and

6.5% versus the prior year period, respectively. The decline was primarily driven by declining sign-ups in the US

business as the commercial weight loss category continued to be impacted by increasing consumer trial of

activity monitors and free apps. As a result, Online paid weeks in the second half of fiscal 2013 were below those

in the prior year period.

In addition to generating revenues from its subscription-based offerings, WeightWatchers.com also provides

a means for companies to advertise on our websites. This advertising revenue increased at a compound annual

growth rate of 4.4% from fiscal 2009 to fiscal 2013. This increase was driven primarily by advertising growth in

the United States followed by Germany.

North America Meeting Metrics and Business Trends

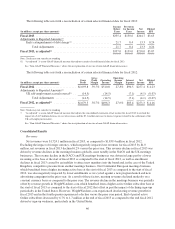

In 2009, the weak economy in the United States had a significant impact on our meetings business. The

economic recession, coupled with reduced credit availability, adversely impacted consumer spending. We saw the

impact most acutely in enrollments, particularly of new members who had never been to Weight Watchers. In fiscal

2009, meeting paid weeks declined by 8.4% versus fiscal 2008. Attendance also declined versus the prior year.

In fiscal 2010, NACO meeting paid weeks declined 1.0% and attendance declined 5.7% versus the prior

year as a result of performance weakness in the early part of the year. In the spring of fiscal 2010, NACO

launched a new marketing strategy and campaign focused on member experience, featuring Jennifer Hudson as

its new spokesperson. With this change, business performance began an improvement trend in the second quarter

of fiscal 2010 that continued through the rest of the year. In addition, NACO initiated other growth strategies

during fiscal 2010, including revamping the retail structure in select markets. These new strategies coupled with

the launch of the PointsPlus program in late November resulted in a positive end to fiscal 2010, with solid

growth in the fourth quarter in both meeting paid weeks and attendance, up 4.2% and 6.8%, respectively, versus

the fourth quarter of 2009.

In fiscal 2011, NACO meeting paid weeks increased 26.4% and attendances increased 18.8% versus the

prior year level. We entered fiscal 2011 with more active members than at the beginning of fiscal 2010 driven by

the momentum of the new program launch and supported by strong marketing and public relation activities. The

quarterly growth trend in meeting paid weeks and attendances in fiscal 2011 versus prior year quarters continued

to be strong, albeit at a slightly slower pace, as we began to cycle against the highly successful marketing

campaign in the second quarter of fiscal 2010 and the soft launch of our new program innovation in the fourth

36