WeightWatchers 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

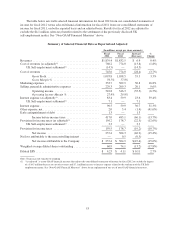

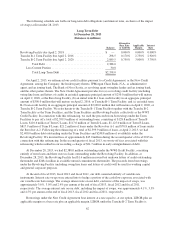

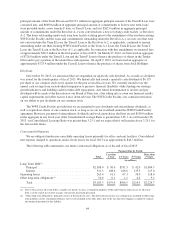

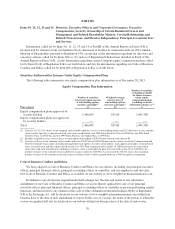

Cash Flows

The following table sets forth a summary of the Company’s cash flows for the fiscal years ended:

December 28,

2013

December 29,

2012

December 31,

2011

(in millions)

Net cash provided by operating activities ..... $323.5 $ 336.7 $ 407.0

Net cash used in investing activities ......... $(145.3) $(109.5) $ (45.2)

Net cash used in financing activities ......... $ (74.4) $(211.1) $(352.0)

Operating Activities

Fiscal 2013

Cash flows provided by operating activities of $323.5 million for fiscal 2013 decreased by $13.2 million

from $336.7 million in fiscal 2012. The decrease in cash provided by operating activities was primarily the result

of lower net income in fiscal 2013 as compared to the prior year offset by the non-cash early extinguishment of

debt charge and the intangible and long-lived asset impairment charges in fiscal 2013 as well as a payment to

HMRC in fiscal 2012 in connection with the previously reported UK self-employment liability.

The $323.5 million of cash flows provided by operating activities for fiscal 2013 exceeded the period’s net

income by $118.8 million. The excess of cash flows provided by operating activities over net income arose

primarily from changes in our working capital as described above (see “—Balance Sheet Working Capital”),

non-cash expenses and differences between book and cash taxes.

Fiscal 2012

Cash flows provided by operating activities of $336.7 million in fiscal 2012 decreased by $70.3 million

from $407.0 million in fiscal 2011. The decrease in cash provided by operating activities was primarily the result

of lower net income in fiscal 2012 versus the prior year, a payment of $30.0 million to HMRC, as well as a $7.4

million accrual reversal based on the settlement of the UK self-employment matter.

The $336.7 million of cash flows provided by operating activities for fiscal 2012 exceeded the period’s net

income attributable to the Company by $79.3 million. The excess of cash flows provided by operating activities

over net income arose primarily from changes in our working capital as described above (see “—Balance Sheet

Working Capital”), non-cash expenses and differences between book and cash taxes.

Investing Activities

Fiscal 2013

Net cash used for investing activities totaled $145.3 million in fiscal 2013, an increase of $35.9 million as

compared to fiscal 2012. This increase was primarily attributable to the $83.8 million aggregate purchase price

paid for franchise acquisitions completed in 2013. In fiscal 2013, we acquired substantially all of the assets of the

following franchisees: Weight Watchers of Alberta Ltd. and Weight Watchers of Saskatchewan Ltd. for an

aggregate purchase price of $35.0 million, Weight Watchers of West Virginia, Inc. for a net purchase price of

$16.0 million, Weight Watchers of Columbus, Inc. for a net purchase price of $23.3 million, Weight Watchers of

Northern Nevada, Inc. for a net purchase price of $4.0 million, Weight Watchers of Manitoba Ltd. for a net

purchase price of $5.2 million, and Weight Watchers of Franklin and St. Lawrence Counties Inc. for a net

purchase price of $0.3 million. In addition, we incurred capital expenditures in connection with the move of our

headquarters, our retail initiative and capitalized software expenditures to support our customer relationship

management platform and other global systems initiatives.

60