WeightWatchers 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Income Margin

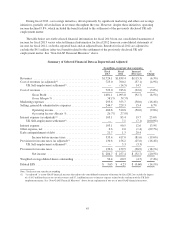

Excluding the impact of the settlement of the UK self-employment matter, our operating income margin in

fiscal 2013 decreased to 26.7% from 27.0% in fiscal 2012. This decline in operating income margin was

primarily driven by the decline in gross margin and higher selling, general and administrative expenses, which

were partially offset by the absence of a Weight Watchers Online US men’s specific marketing campaign,

achieving lower and more efficient digital marketing spend in the United States in fiscal 2013 and lower TV

advertising and production costs globally versus fiscal 2012. In fiscal 2013, marketing expenses decreased as a

percentage of revenue, but this decrease was slightly offset by the increase in selling, general and administrative

expenses as a percentage of revenue, as compared to the prior year.

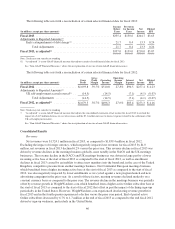

Interest Expense

Interest expense was $103.1 million for fiscal 2013, an increase of $12.6 million, or 13.9%, from $90.5

million in fiscal 2012. Excluding the impact of the 2012 settlement of the UK self-employment matter, interest

expense increased $19.7 million or 23.6% versus the prior year. The increase was primarily driven by an increase

in our average debt outstanding and higher interest rates on our debt. Our average debt outstanding increased by

$294.4 million to $2,397.3 million in fiscal 2013 from $2,102.9 million in fiscal 2012. The increase in average

debt outstanding was driven by the additional borrowings under our then existing credit facilities in March and

April 2012 in connection with our repurchase of shares in the Tender Offer and the related share repurchase from

Artal Holdings (see “—Liquidity and Capital Resources—Stock Transactions”). The effective interest rate on our

debt increased by 0.58% to 3.49% in fiscal 2013 from 2.91% in fiscal 2012 as a result of our April 2, 2013 debt

refinancing. Interest expense was partially offset by a decrease in the notional value of our interest rate swap,

which resulted in a higher effective interest rate of 3.92% in fiscal 2013, as compared to 3.60% in fiscal 2012.

Other Expense

The Company incurred $0.6 million of other expense in fiscal 2013 as compared to $2.0 million of other

expense in the prior year. While both years include the impact of foreign currency on intercompany transactions,

the prior year also includes $2.4 million of expense resulting from a write-off associated with an investment.

Early Extinguishment of Debt

In the second quarter of fiscal 2013, we wrote-off $21.7 million of fees in connection with the April 2013

refinancing of our debt that we recorded as an early extinguishment of debt charge. In the first quarter of fiscal

2012, we wrote-off $1.3 million of fees in connection with the March 2012 refinancing of our debt that we

recorded as an early extinguishment of debt charge.

Tax

Our effective tax rate was 39.0% for fiscal 2013 as compared to 38.3% for fiscal 2012. For fiscal 2012, the

UK self-employment matter impacted our effective tax rate. Excluding the impact of the settlement of the UK

self-employment matter, our effective tax rate for fiscal 2012 would have been 38.1%. The difference in period-

over-period effective tax rates is primarily the result of the lack of a tax benefit recorded for certain non-

deductible impairments charges recorded in fiscal 2013 as well as the impact of a non-recurring tax benefit

recorded in fiscal 2012 associated with a reduction in certain international tax rates.

51